Estimates of the Value of Federal Tax Exemptions and Community Benefits Provided by U.S. Nonprofit Hospitals, 2022

Prepared for the American Hospital Association by EY

November 2025

EY was commissioned by the American Hospital Association to analyze the federal revenue forgone due to the tax exemptions of U.S. nonprofit hospitals relative to the community benefits they provide.1 This study presents estimates for 2022, the most recent year for which complete comparable community benefit information is available for nonprofit hospitals. The study is based on Medicare hospital cost reports for approximately 2,400 nonprofit acute care hospitals and IRS Forms 990, Schedule H data. The analysis does not account for other tax-exempt specialty hospitals, such as psychiatric or long-term acute care.2

For the first time, this year’s analysis includes a review of both state and local tax exemptions, providing a more complete picture of the total value of tax benefits received by nonprofit hospitals.

Estimates of the Value of Federal Tax Exemptions and Community Benefits Provided by U.S. Nonprofit Hospitals, 2022

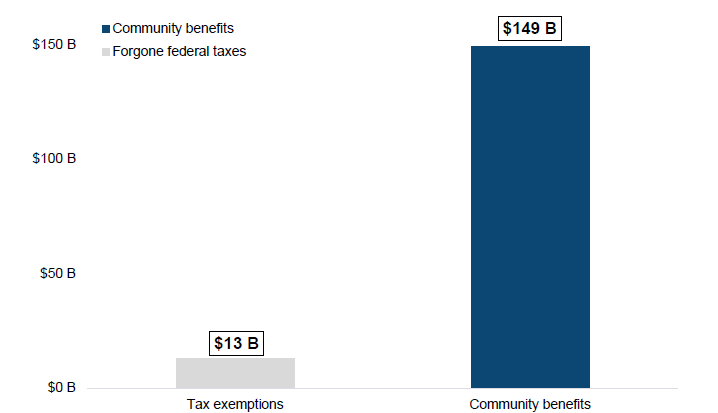

In 2022, the estimated federal tax revenue forgone due to the tax-exempt status of nonprofit hospitals was $13.2 billion. In comparison, the total benefit nonprofit hospitals provided to their communities, as reported on the Form 990 Schedule H, is estimated to be $149 billion, over 11 times greater than the value of their federal tax revenue forgone.

Figure 1 displays federal tax revenue forgone due to the tax benefits available to nonprofit hospitals compared to the value of hospital-provided financial assistance and other community benefits. Total community benefits are calculated at cost for nonprofit hospitals from the IRS Form 990 Schedule H.

Figure 1. Federal Tax Revenue Forgone Compared to Community Benefits Provided by U.S. Nonprofit Hospitals, 2022

Sources: EY tabulations of tax year 2022 data from hospital cost reports. Community Benefit from ‘Results from 2022 Tax-Exempt Hospitals’ Schedule H Community Benefit Reporting’ American Hospital Association, September 2025.

Note: Total community benefits summarize financial assistance and means tested government programs and other benefits (Part I, line 7k of the Schedule H Form 990), Community-building activities (Part II of the Form 990 Schedule H), Medicare shortfall (Part III, line 7 of the Schedule H Form 990), and bed debt attributable to charity care (Part III, line 3 of the Schedule H Form 990).

Federal Revenue Forgone from U.S. Nonprofit Hospitals, 2022

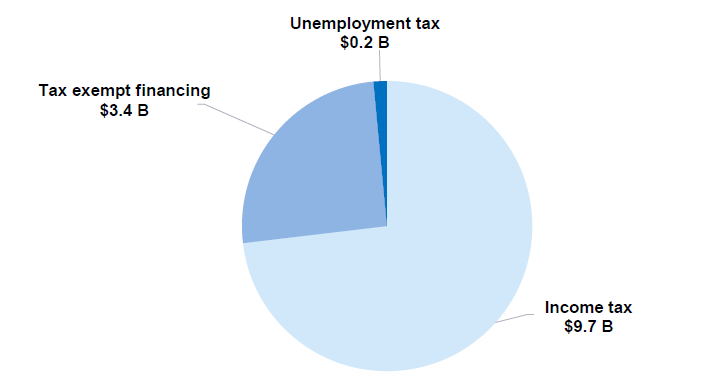

Three tax provisions that provide a federal exemption for nonprofit hospitals are analyzed:

- Federal corporate income tax exemption.

- Tax-exempt bond financing.

- Federal unemployment tax exemption.

The value of the federal revenue forgone due to these three tax exemptions in 2022 is estimated to be $13.2 billion. Federal tax exemptions include $9.7 billion in federal income taxes, $3.4 billion in tax-exempt financing and $0.2 billion in unemployment taxes. Figure 2 shows the makeup of federal tax revenue forgone for 2022.

Figure 2. Federal Tax Revenue Forgone by U.S. Nonprofit Hospitals, 2022

Sources: EY tabulations of tax year 2022 data from hospital cost reports.

This analysis estimates total tax revenue forgone as a result of these three federal tax provisions by relying on data from the Medicare hospital cost reports filed by hospitals that receive Medicare reimbursements. The hospital cost reports are not audited financial reports, but are filed by hospitals with the federal government. In 2022, 2,415 private, nonprofit, acute care hospitals filed Medicare hospital cost reports.3 The results are then grossed up to the entire field using data from the 2022 AHA Annual Survey of Hospitals and from the AHA Schedule H Community Benefit Reporting study.4

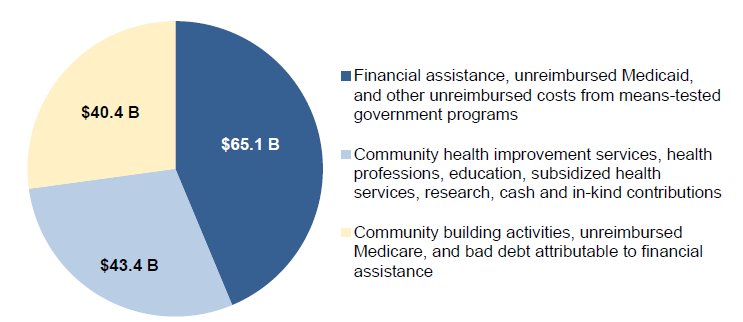

Total Community Benefit Provided by Nonprofit Hospitals in 2022

The total benefits to the community provided by nonprofit hospitals in 2022 are estimated to be $148.9 billion. Figure 3 provides a high-level breakout of the community benefit types. This includes $65.1 billion in financial assistance, unreimbursed Medicaid and other unreimbursed costs from means-tested government programs. In addition, $43.4 billion reflects community health improvement services, health professions education, subsidized health services, research, and cash and in-kind contributions. Furthermore, $40.4 billion reflects community building activities, unreimbursed Medicare and bad debt attributable to financial assistance.

Figure 3. Community Benefits Provided by U.S. Nonprofit Hospitals, 2022

Sources: EY tabulations of tax year 2022 data from hospital cost reports. Community Benefit from ‘Results from 2022 Tax-Exempt Hospitals’ Schedule H Community Benefit Reporting’ American Hospital Association, September 2025. Note: Total community benefits summarize financial assistance and means tested government programs and other benefits (Part I, line 7k of the Schedule H Form 990), Community-building activities (Part II of the Form 990 Schedule H), Medicare shortfall (Part III, line 7 of the Schedule H Form 990), and bed debt attributable to charity care (Part III, line 3 of the Schedule H Form 990).

The information compiled for this analysis of the value of benefits to the community comes from four items reported on Form 990 Schedule H as compiled by the American Hospital Association:

- Financial assistance and means-tested government programs and other benefits (Part I, line 7k of the Form 990 Schedule H).

- Line 7d represents the subtotal for financial assistance, unreimbursed Medicaid and other unreimbursed costs from means-tested government programs.

- ii. Line 7j represents the subtotal for other benefits (community health improvement services, health professions education, subsidized health services, research, and cash and in-kind contributions).

- Community-building activities (Part II of the Form 990 Schedule H).

- Medicare shortfall (Part III, line 7 of the Form 990 Schedule H).

- Bad debt attributable to charity care (Part III, line 3 of the Form 990 Schedule H).

The Value of State and Local Tax Exemptions for Nonprofit Hospitals, 2022

In addition, we analyzed three state tax provisions that provide a state and local exemption for nonprofit hospitals:

- State corporate income tax exemption.

- State and local sales tax exemption.

- State and local real and tangible personal property tax exemption.

These state-by-state estimates are incorporated into federal tax calculations as deductions from taxable income. They also may be considered as standalone estimates of the value of state and local tax exemptions.

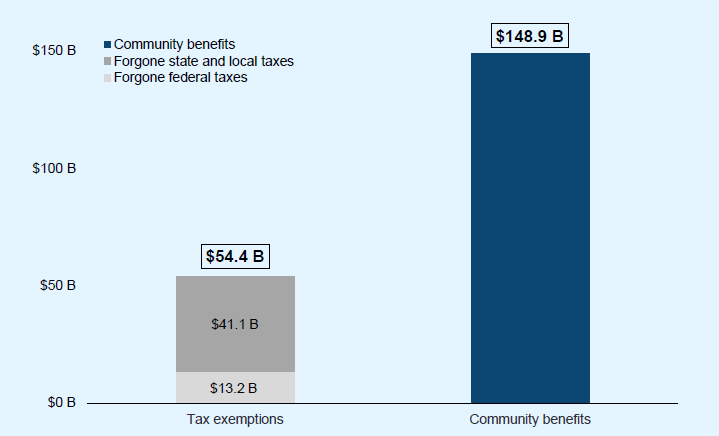

In 2022, we estimate that state and local tax benefits available to non-profit hospitals were $41.1 billion. Combined with our estimate of 2022 federal tax benefits, the revenue forgone due to the total tax-exempt status of nonprofit hospitals is $54.4 billion. Therefore, even after including state and local tax benefits, the community benefit provided by nonprofit hospitals is three times greater than the value of their total tax revenue forgone. Figure 4 displays tax revenue forgone due to both $13.2 billion in federal tax benefits and $41.1 billion in state tax benefits available to nonprofit hospitals, compared to the value of hospital-provided financial assistance and other community benefits.

Figure 4. Federal, State, and Local Tax Revenue Forgone Compared to Community Benefits Provided by U.S. Nonprofit Hospitals, 2022

Sources: EY tabulations of tax year 2022 data from hospital cost reports. Community Benefit from ‘Results from 2022 Tax-Exempt Hospitals’ Schedule H Community Benefit Reporting’ American Hospital Association.

Note: Total benefit to the community summarizes financial assistance and means tested government programs and other benefits (Part I, line 7k of the Schedule H Form 990), Community-building activities (Part II of the Form 990 Schedule H), Medicare shortfall (Part III, line 7 of the Schedule H Form 990), and bed debt attributable to charity care (Part III, line 3 of the Schedule H Form 990).

Methodology

Approach for Estimating Taxable Income and Adjustments to Reported Income Incorporated in the Estimate of Revenue Forgone from Corporate Income Tax Exemption

In this analysis, we apply general federal and state tax rules to the levels of tax-exempt activities reported by nonprofit hospitals. Not all aspects of these general tax rules can be applied to the available financial data in the hospital cost reports. Thus, certain estimates of revenue forgone require additional data and/or assumptions, which are described below.

The estimate of corporate taxable income starts with the positive net income before adjustments for each hospital as reported in the Medicare hospital cost reports. The cost reports, similar to financial reports, do not include the entire income and expense detail necessary to reconstruct a corporate income tax return. In estimating the interest deduction, the 30% limitation was used.5 Adjustments for positive and negative differences between book and tax accounting are not made due to insufficient detail in the Medicare hospital cost reports. For example, the provision for bad debt is likely to reduce financial statement income as compared with taxable income, while accelerated tax depreciation is likely to reduce taxable income as compared with financial statement income.

In addition, the following assumptions and adjustments are incorporated into our income tax calculations:

- Bonus depreciation not reflected. In 2022, federal tax law allowed bonus depreciation that provided additional first-year tax write-offs of capital investments as part of fiscal stimulus. Bonus depreciation applied only to certain qualifying property, and some state tax systems did not conform to this provision.6 Due to this complexity and data constraints, bonus depreciation was not considered in this analysis. Had bonus depreciation been reflected in the estimates, it would have reduced the federal corporate income tax forgone in 2022.

- Consolidation with affiliates. The analysis assumes that nonprofit hospitals would take advantage of tax consolidation rules with affiliated hospitals if they were subject to tax. Thus, a hospital with a taxable loss could offset the positive taxable income of a consolidated hospital in the current year.7 Using an affiliation listing provided by the American Hospital Association, the consolidated taxable income of all nonprofit hospitals was estimated. On net, the consolidation of hospitals reduces overall taxable income.

- Contributions excluded from income. The analysis reduces hospitals’ taxable income by the amount of contributions received. If contributions constitute gifts for federal income tax purposes, such gifts are not included in taxable income but may be subject to gift tax. Restricted gifts used for capital improvements may not be included in taxable income if certain conditions are met, in which case they would reduce the taxable basis of the capital improvements. Further, if contributions to hospitals are not eligible for a tax deduction, it is assumed that most donors would choose other qualified organizations. For these reasons, the contributions are excluded from the estimate of corporate taxable income.

- State and local taxes. Many hospitals would automatically pay higher state and local taxes in the absence of the federal tax exemption. Thus, estimates on a state-by-state basis of the potential sales tax on business inputs and of potential property taxes on nonprofit hospitals were incorporated in the federal tax calculations as deductions from taxable income.8 Increased state corporate income taxes also would be deductible against federal taxable income, and this factor is also reflected in the analysis.

- Prior year losses. Finally, the federal corporate income tax does not tax businesses only on their net positive income in each year, but instead allows for net operating losses (NOLs) to offset taxable income to be carried forward, offsetting positive taxable income in future years.9 For tax loss carryforwards, financial statement income losses from 2012 through 2021 were applied against positive taxable income for each year, with any remaining losses applied to positive income from 2022. The tax loss carryover rules, similar to the tax consolidation rules, result in taxable income being lower than positive financial net income in all years analyzed.

The estimated value of revenue forgone from taxable income is $9.7 billion for federal taxable income.

Estimate of Federal Revenue Forgone from Tax-exempt Bond Financing

This analysis calculates forgone revenue from tax-exempt bond financing to U.S. nonprofit hospitals. The estimate assumes the total amount of notes payable and other long-term liabilities outstanding as reported in the audited financial statements were issued as federally tax-exempt bonds. The analysis assumes that the average marginal tax rate applicable to investors in tax-exempt bonds is approximately 30 percent.10 Applying this tax rate to the 10-year average taxable yields of Aaa and Baa corporate bonds and tax-exempt debt outstanding in each of the years, the estimated value of revenue forgone from tax-exempt bonds of nonprofit hospitals is $3.4 billion for 2022. To the extent that nonprofit hospitals are using short-term financing with lower yields, the revenue forgone would be lower.

It should be noted that the benefit received by the hospital issuer is likely smaller than the federal revenue forgone, as the amount of revenue forgone is dependent on all the marginal tax brackets of the investors, whereas the market-clearing interest rate may be for a lower marginal tax bracket than many of the other bondholders. Furthermore, investors may not convert the entire tax benefit they receive into a lower cost of financing for the hospital.

Estimate of the Revenue Forgone from Federal Unemployment Tax

The value of the revenue forgone from the federal unemployment tax is calculated assuming an effective federal unemployment tax rate of 0.6% and a maximum wage base of $7,000 per employee. This rate assumes that nonprofit hospitals are paying state and local unemployment taxes or their equivalent, which is creditable up to 5.4% against the full federal rate of 6%. Based on the 4.4 million employees across private nonprofit hospitals, the value of the exemption from federal unemployment tax is estimated to be $0.2 billion in 2022.11

Estimate of State and Local Revenue

To estimate the value of real and personal property tax exemptions, average effective state property tax rates are applied to reported real and tangible personal property fixed assets. Sales and use tax exemptions are from the reported taxable sales tax liability for operating and capital expenses. The methodology for estimating state corporate income tax exemptions is similar to that used for federal income taxes. The value of the tax exemption from state and local tax revenue is estimated to be $41.1 billion in 2022.

Limitations of Analysis

The estimates in this report reflect the upper bound of the potential values of the federal, state, and local tax exemptions for several reasons:

- Charitable status: Some hospitals may qualify for tax exemption due to their educational or religious nature, in addition to their charitable nature. In the absence of a tax exemption for charitable hospitals, certain institutions could continue to be exempt for other reasons.

- Potential federal, state, and local tax credits: Tax credits such as enterprise zone and work opportunity tax credits, and special deductions are not included in this analysis due to lack of necessary information.

- Routine tax planning: Taxable companies routinely plan their operations and structures to minimize tax contributions, which could result in hospitals reporting lower taxable income than suggested by financial statements for exempt entities.

- Static estimates: This is a static, non-behavioral calculation of the estimated value of current tax exemptions. The estimates assume no behavioral changes on the part of the hospitals, although some behavioral changes would likely occur if the hospitals were to become taxable. If subject to taxation, there might be an incentive to take advantage of existing tax deductions, other exemptions, and tax credits to reduce the cost of federal, state, and local tax liabilities.

- Unrelated business income tax: Some nonprofit hospitals already pay income tax on a small portion of their income.12 Had current payments of this tax been considered, the estimate of the value of foregone income taxes would be reduced.

- Deductibility of donations: 501(c)(3) tax-exempt organizations, including nonprofit hospitals, are eligible to receive tax-deductible charitable contributions. If donations to nonprofit hospitals were not deductible, many donors would likely donate to other charitable organizations instead. Because the tax-exempt status of hospitals results in a tax benefit to their donors, rather than to the hospitals, the value of this benefit is not included in this calculation.

Endnotes

- The methodology used in this report is consistent with Ernst & Young studies previously completed on behalf of the American Hospital Association (released February 2013, October 2017, May 2020 and September 2024).

- AHA’s 2022 Annual Hospital Statistics Survey indicates there are 6,093 registered hospitals in the U.S. This includes community, federal government, psychiatric, long-term care and other hospitals. There are 5,139 community hospitals, which include non-governmental nonprofit (2,960 hospitals), investor-owned for-profit (1,228 hospitals), and state and local government (951 hospitals). The remaining 954 hospitals are made up of the federal government, psychiatric, long-term care and other hospitals (e.g., prison hospitals).

- Hospitals were identified based on AHA’s 2022 Annual Hospital Statistics Survey. The Survey defines a general medical hospital as follows: “Provides acute care to patients in medical and surgical units on the basis of physicians’ orders and approved nursing care plans.” In terms of the hospitals used for this analysis, there were 2,415 hospitals in the 2022 Medicare hospital cost reports.

- This gross up is done by taking the federal revenue forgone as a percent of total hospital expense for the 2,415 hospitals in the CMS data. The community benefit data from the IRS Form 990 Schedule H already includes a percent of total hospital expense calculation. The total hospital expense number from the AHA Survey of Hospitals for 2020 for nonprofit general medical hospitals is used to calculate the total revenue forgone and community benefits dollars. This makes comparable the tax savings and community benefits calculations.

- The Tax Cuts and Jobs Act (2017) limited deductible interest to 30% of adjusted taxable income.

- Murray, J. (2020, December 29). Bonus Depreciation and How It Affects Business Taxes. The Balance. Retrieved from: https://www.thebalancemoney.com/what-is-bonus-depreciation-398144

U.S. Bank. (2024, January 29). Maximizing you deductions: Section 179 and Bonus Depreciation. Retrieved from: https://www.usbank.com/financialiq/improve-your-operations/industry-insights/maximizing-your-deductions-section-179-and-bonus-depreciation.html#:~:text=The%20rules%20allowed%20Bonus%20Depreciation,reduced%20to%2060%25%20for%202024. - For example, two independent hospitals, one with a net operating loss (NOL) of $10M and one with a taxable income of $10M, have an aggregate taxable income of $10M in that year, since the hospital with the NOL has a taxable income of zero, with a potential carryover of the loss against the hospital’s future taxable income. If these two hospitals joined together into a system that files a federal consolidated return, the net operating loss from the first hospital would offset the taxable income of the second, leading to a consolidated taxable income of $0, $10M less than if the two hospitals were separate.

- Council on State Taxation, Total State and Local Business Taxes: Nationally 1980-2022 and by State 2000-2022, October 2020. The methodology used by Ernst & Young in this study was used for the state-by-state hospital estimates of sales tax on business inputs and property taxes.

- For 2022, federal tax law allows a taxpayer to carry losses forward indefinitely (Tax Cuts and Jobs Act, 2017 and CARES Act, 2020). Rules for state income taxes vary from state to state.

- The analysis uses an average marginal rate applicable to investors in tax exempt bonds of 30 percent. This number is likely far higher than the actual average (CBO estimates for 2007 ran as low as 21 percent). This analysis assumes the higher percentage in order to provide a more conservative estimate, as a lower average marginal tax rate would lead to a lower amount of federal revenue forgone for tax-exempt financing.

- The U.S. Census Bureau’s County Business Patterns reports approximately 5.6 million employees for all “nonprofit hospitals” for 2022. This definition of nonprofit hospitals includes public facilities. Another Census Bureau program, the 2021 Annual Survey of Public Employment & Payroll, reports approximately 1.2 million employees for public hospitals for the same periods. The number of employees of private, nonprofit hospitals is calculated as total nonprofit employment less government hospital employment.

- For example, in 2013, there were 393 tax returns that paid a total of $52 million in unrelated business income classified as “Healthcare and social assistance”. This may not account for all unrelated business income taxes paid by hospitals, as taxes paid may have been classified under a different category, such as “retail trade” for gift shop sales. Tax year 2013 is the last year of reporting for this statistic. Source: Internal Revenue Service Statistics of Income (SOI) Tax Stats – Exempt Organizations’ Unrelated Business Income (UBI) Tax Statistics, October 2016.