Agencies Issue ‘Part Two’ of Regulations Banning Surprise Medical Bills

AHA Special Bulletin

October 1, 2021

The Office of Personnel Management, along with the departments of Health and Human Services (HHS), Labor, and Treasury (referred to as the departments) yesterday issued additional regulations implementing key sections of the No Surprises Act. This interim final regulation, referred to as “Part II,” addresses the independent dispute resolution (IDR) process providers and plans may use to adjudicate outstanding reimbursement disputes, the good faith cost estimates providers must share with uninsured or self-pay patients for scheduled services, a process to resolve disputes between uninsured/self-pay patients and providers, and an external review process as part of the oversight of health plan/issuer compliance. The agencies also established a website where interested parties can apply to serve as an IDR entity and where providers and plans may initiate the process.

While most of the provisions in the regulations go into effect Jan. 1, 2022, the agencies will begin accepting applicants to serve as IDR entities as early as Nov. 1, 2021. Comments on the rule are due 60 days after publication in the Federal Register, which is scheduled for Oct. 7, 2021.

AHA Take

In a statement shared yesterday with the media, AHA said, “The No Surprises Act was an important step forward in protecting patients from surprise medical bills. Hospitals and health systems strongly support these protections and the balanced approach Congress chose to resolve disputes. Disappointingly, the Administration’s rule has moved away from Congressional intent and brought new life to harmful proposals that Congress deliberately rejected.”

Highlights of the regulations follow. Additional information will be provided in subsequent analysis provided by the AHA.

MAJOR PROVISIONS

Federal Independent Dispute Resolution (IDR) Process

The interim final rule implements the federal IDR process that is available to providers, facilities, plans and issuers in the event that agreement cannot be reached on the out-of-network (OON) reimbursement amount following a 30-day “open negotiation” period. In general, the IDR process is similar to “baseball style arbitration” through which two parties bring their best and final offer, along with supporting evidence, and the IDR entity selects what it deems to be the most appropriate offer, consistent with the rules and guidance established by the government. The IDR entity’s decision is binding.

The following provides a high level summary of the IDR process, the role of the qualified payment amount (QPA), the batching of claims, fees associated with the process, timelines, and certification of the IDR entities. The federal government will use a “Federal IDR portal” to solicit IDR entity applications and for providers, facilities, plans, and issuers to initiate and complete the process.

Initiation of the IDR Process

Providers, facilities, plans, and issuers must first complete a 30-day “open negation” period to determine the OON payment amount. If the parties cannot come to agreement on the reimbursement amount during that time, either party may initiate the IDR process and inform the opposing party of their decision. The process is initiated at the portal provided above. Both parties to the process have the opportunity to jointly select a certified IDR entity. If agreement cannot be reached, the departments will select the IDR entity.

Role of the QPA

The QPA, which is generally the plan’s or issuer’s median in-network rate for the item or service, is the starting point for the IDR determination of the OON payment amount. The final rule clearly articulates the departments’ position that when selecting between two offers, the certified IDR entity must begin with the presumption that the QPA is the appropriate OON amount. However, the arbiters also are instructed by statute and the final rule to consider other factors, such as the level of training, experience, quality and outcomes of the provider; the market share held by the provider and/or the plan; patient acuity; and teaching status, case mix, and scope of services of the provider. However, the rule states unequivocally that the QPA is to be considered the most significant factor in determining the OON rate in the payment dispute. The departments’ expectation is that this creates an incentive on parties to only bring claims that warrant substantial deviation from the QPA.

Batching of Claims

Providers and facilities can batch similar claims in a single IDR request, subject to certain conditions. All of the following conditions must be met to batch claims: the items and services must use similar procedural codes and have been billed by the same provider, group of providers or facilities; billed to the same plan or issuer; and occurred within 30-business days or within the 90-day “cooling off” period between IDR requests for same or similar services.

Fees Associated with the IDR Process

Each party to an IDR payment determination must pay an administrative fee at the time the certified IDR entity is selected. The administrative fee is paid by each party to the certified IDR entity and remitted to the departments. The administrative fee is established annually in a manner so that the total administrative fees collected for a year are estimated to be equal to the amount of expenditures estimated to be made by the departments. The departments released federal guidance regarding the establishment of the administrative fees for the IDR process, which can be found here: Calendar Year 2022 Fee Guidance for the Federal Independent Dispute Resolution Process under the No Surprises Act.

For 2022, each party must pay an administrative fee of $50. The non-prevailing party is responsible for the certified IDR entity fee for the use of this process. For 2022, the IDR entity fee for single determinations are expected to be within the range of $200-$500 unless otherwise approved by the departments.

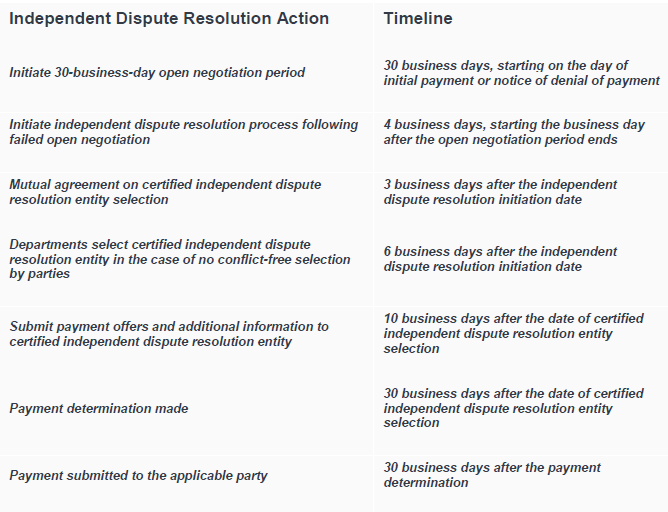

Timeline for the IDR Process

The departments establish the following timeline, which is largely consistent with the statute, and provide a process for extending the timeline in the event of extenuating circumstances. In addition, the departments clarified that the timeline will use business days and not calendar days.

Certification of IDR Entities, Reporting and Process for Revocation of an Entity

The departments will certify IDR entities on a rolling basis. Interested organizations wishing to be certified by Jan. 1, 2022 must submit their application by Nov. 1, 2021. More information on the certification process can be found at the portal at: https://www.cms.gov/nosurprises/Help-resolve-payment-disputes.

The statute and final rule list the types of organizations that are eligible to become IDR entities, as well as those that cannot be considered due to conflicts of interests. For example, providers, facilities, plans, and issuers, as well as their trade associations and any subsidiaries, are prohibited from being designated as IDR entities. Eligible entities must have arbitration experience and be knowledgeable in health care.

The rule also provides a process by which members of the public, including providers, facilities, providers of air ambulance services, and plans and issuers, can petition for the denial or revocation of certification of an IDR entity.

Additionally, the rule establishes monthly reporting requirements for certified IDR entities to inform quarterly public reports on payment determinations to ensure transparency in the IDR process.

Good Faith Estimates for Uninsured or Self-pay Patients

The regulation establishes the process for providing uninsured and self-pay patients good faith estimates prior to all scheduled services or by request if the patient is shopping for care and not yet at the point of scheduling. The rule clarifies that the good faith estimates must include all expected charges for the items or services that are reasonably expected to be provided together with the primary item or service, including items or services that may be provided by other providers and facilities. The “convening provider,” defined as the provider/facility that is responsible for scheduling the primary item or service or receives the initial request for a good faith estimate, will be responsible for coordinating the estimates from all providers and delivering the estimate to the patient. The convening provider also will be responsible for notifying uninsured and self-pay patients of the availability of a good faith estimate; HHS anticipates providing a model notice for this purpose.

The rule details the information that must be included in the good faith estimate, including:

- The patient’s name and date of birth;

- A description of the primary item or service;

- An itemized list of other items or services, grouped by each provider/facility, reasonably expected to be provided with the primary item or service during the period of care;

- Applicable diagnosis and service codes, with expected charges listed with each item/service;

- The name, National Provider Identifier (NPI), and Taxpayer Identification Number (TIN) of each provider/facility included in the good faith estimate;

- A list of items/services the convening provider anticipates will require separate scheduling, before or after the primary service (e.g., physical therapy); and

- Several disclaimers, including one alerting the patient to their right to initiate a patient-provider dispute resolution process if the billed charges are “substantially in excess” of the good faith estimates.

Notably, the rule makes clear that the expected charges must reflect any available discounts or other relevant adjustments that the provider or facility expects to apply to an uninsured or self-pay individual’s billed charges. The rule also discusses the applicable period of care covered by the good faith estimate, defined as the day or multiple days during which the primary item(s) or service(s) are delivered (e.g., inclusive of anesthesia during surgery, but not including pre-surgery consultations or post-surgery physical therapy).

The rule establishes that the good faith estimates must be provided in writing, either on paper or electronically, based on the patient’s preference. The convening provider is required to request good faith estimate information from all other providers within one business day, and deliver the complete good faith estimate to the patient within one business day if the scheduled service is within 3-9 days or three business days if the scheduled service is in 10+ days or has not been scheduled yet.

These requirements go into effect on Jan. 1, 2022. However, HHS plans to exercise enforcement discretion through Dec. 31, 2022, and encourages states to do the same, as it relates to incorporating the good faith estimates from outside providers or facilities. HHS recognizes that there is not an established process for the convening provider and other providers to share information on expected charges, and asks for comment on how this could be accomplished.

Patient/Provider Dispute Resolution Process

The regulations implement the patient-provider dispute resolution process established under the No Surprises Act for instances when billed charges are “substantially in excess” of the good faith estimates provided prior to care. Patients are eligible for the dispute resolution process if the total billed charge(s) for a particular provider/facility is at least $400 higher than the combined good faith estimates of charges for that provider/facility. In other words, while the convening provider (defined in the above section) is responsible for coordination and delivery of the estimates, each individual provider/facility is responsible for the accuracy of their own estimates.

Patients will have 120 days after receiving a bill to initiate the dispute resolution process. They can initiate the process through the federal IDR portal, electronically, or through paper mail. There will be a $25 administrative fee for patients to initiate this process. Select dispute resolution entities (chosen by HHS) will make the final payment determinations, unless the patient and provider chose to settle prior to that process.

External Review Process

These regulations makes several changes to existing rules that require an external review process as part of health plan/issuer oversight. Specifically, this rule expands the scope of adverse benefit determinations eligible for external review to include determinations on claims subject to the surprise billing and cost-sharing protections under the No Surprises Act and corresponding regulations. In addition, this regulation newly subjects grandfathered health plans to the external review process requirements, specifically for purposes of oversight of compliance with No Surprises Act provisions.

NEXT STEPS

Comments on the interim final rule are due 60 days after publication in the Federal Register. If you have questions, please contact AHA at 800-424-4301.

Key Takeaways

The interim final regulations:

- Establish the federal independent dispute resolution process that providers, facilities, plans, and issuers may use to resolve ongoing reimbursement disputes for out-of-network claims subject to the No Surprises Act.

- Require providers to generate and share with uninsured and self-pay patients good faith estimates for all scheduled services, including in instances where the patient may be shopping and not at the point of scheduling.

- Establish a process for uninsured and self-pay patients to dispute provider charges for care that are at least $400 more than the good faith estimate for those same services.

- Modify existing external review requirements as part of health plan/issuer oversight to incorporate provisions related to the No Surprises Act.