Advocacy Issue: Enhanced Premium Tax Credits

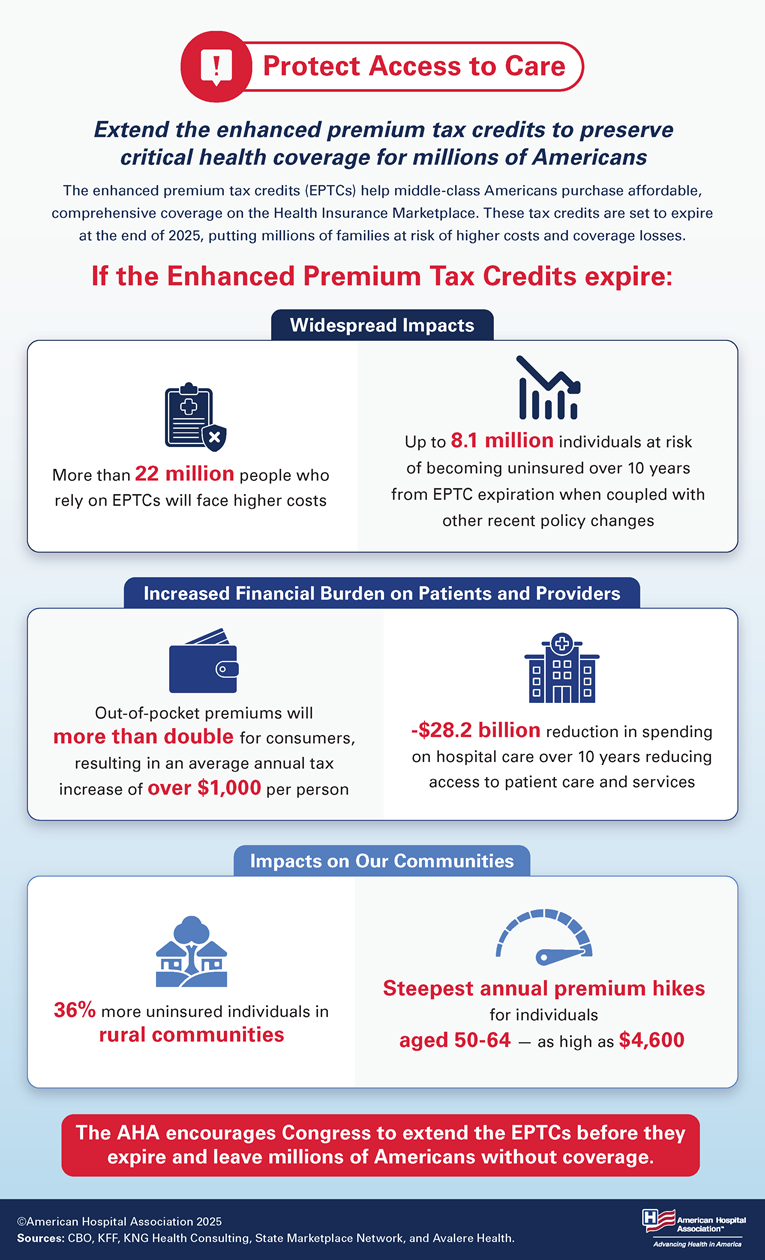

The enhanced premium tax credits (EPTCs) help middle-class Americans purchase affordable, comprehensive coverage on the Health Insurance Marketplace. These tax credits are set to expire at the end of 2025, putting millions of families at risk of higher costs and coverage losses.

AHA Position

The AHA encourages Congress to extend the EPTCs before they expire and leave millions of Americans without coverage.

Key Resources

Latest Enhanced Premium Tax Credit Advocacy and News

Related Resources

Fact Sheets

Advisory