Another Unfounded Attack on Hospitals From The Shadowy Arnold Ventures

A new opinion piece supported by Arnold Ventures and published in the New England Journal of Medicine is another unfair assault on the only sector in health care that routinely gives back so much more to their communities than they receive in tax relief.

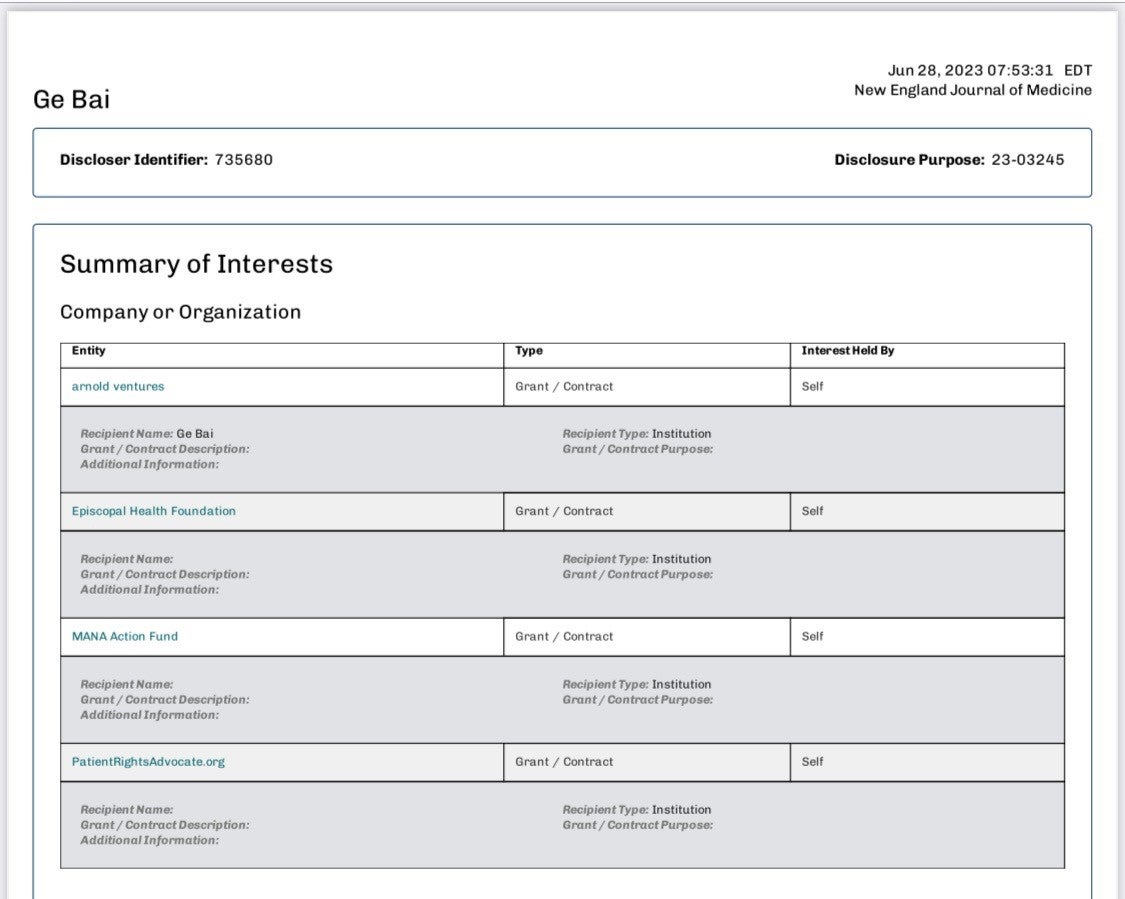

The most revealing sentence in the article comes at the very end: "Disclosure forms provided by the authors are available at NEJM.org." That disclosure says volumes about the unfounded attacks on non-profit hospitals. Specifically, that it is influenced by a shadowy organization with an obvious bias against hospitals.

This article should be understood for what it is: just another attempt by a deep-pocketed organization with a biased agenda to attack hospitals. And it is particularly ironic for an enterprise that relies, in part, on tax exemptions to advance that agenda.

Critically, this piece deliberately downplays essential community benefits hospitals provide and misrepresents an important program designed to assist hospitals serving vulnerable communities called 340B. Employing sketchy math, the piece suggests that supporting vulnerable patients by backstopping a federal program (Medicaid) that routinely underpays hospitals for the cost of services they provide is a contest between hospitals instead of an essential benefit deserving of full credit.

The fact is that hospitals routinely help patients qualify for Medicaid benefits because it provides them with a fuller range of preventive and restorative services than episodic charity care. They do so fully aware that the program underpays for that care but is a better support for their patients and communities.

Tax-exempt hospitals also disclose every year how those savings fund an enormous range of community benefits, from free and heavily discounted care, to free clinics, transportation services, food pantries and other programs and services needed by their communities. That’s more transparency than any other sector of health care provides and more than enough for the communities served to understand whether the range and type of benefits being provided meets its particular needs.

The article also wrongly attacks the 340B program, which was intended from its inception to provide hospitals serving vulnerable communities with the same savings from expensive prescription drugs as the government in order for those hospitals to provide more benefits to more patients. And that’s just what these hospitals do. The reality is America’s hospitals and health systems— regardless of size, location, and type of ownership — do far more than any other part of the health care field to advance health in their communities. This is more than borne out by the data. A comprehensive report by the international accounting firm EY has consistently found that the community benefits provided by tax-exempt hospitals far outweighs the value of their federal tax exemption. In the most recent analysis, the value was 9 to 1: for every one dollar in tax exemption, hospitals provided nine dollars of community benefit. Additionally, a 2022 analysis shows that tax-exempt hospitals provided more than $110 billion in total benefits to their communities in fiscal year 2019 (up from $105 billion in 2018), the most recent year for which comprehensive data is available.

In total, hospitals of all types have provided nearly $745 billion in uncompensated care to patients since 2000, and each day provide a wide range of essential services and programs and services that have invaluable benefits to their communities.

These assaults on the hospital field are unfair and entirely unwarranted. Those supporting them deserve much more scrutiny than the hospitals unfairly targeted and misrepresented.