In 2020, the estimated tax revenue forgone due to the tax-exempt status of nonprofit hospitals is $13.2 billion. In comparison, the benefit tax-exempt hospitals provided to their communities, as reported on the Form 990 Schedule H, is estimated to be $129 billion, almost 10 times greater than the value of tax revenue forgone.

Beginning in 2018, the AHA contracted with Candid to create a file of all Schedule H forms electronically submitted by hospitals to the IRS for the most recently completed tax year, 2020. Using the Candid database, as well as AHA annual survey data, the AHA can now provide benchmark reports to all tax-exempt hospitals and systems.

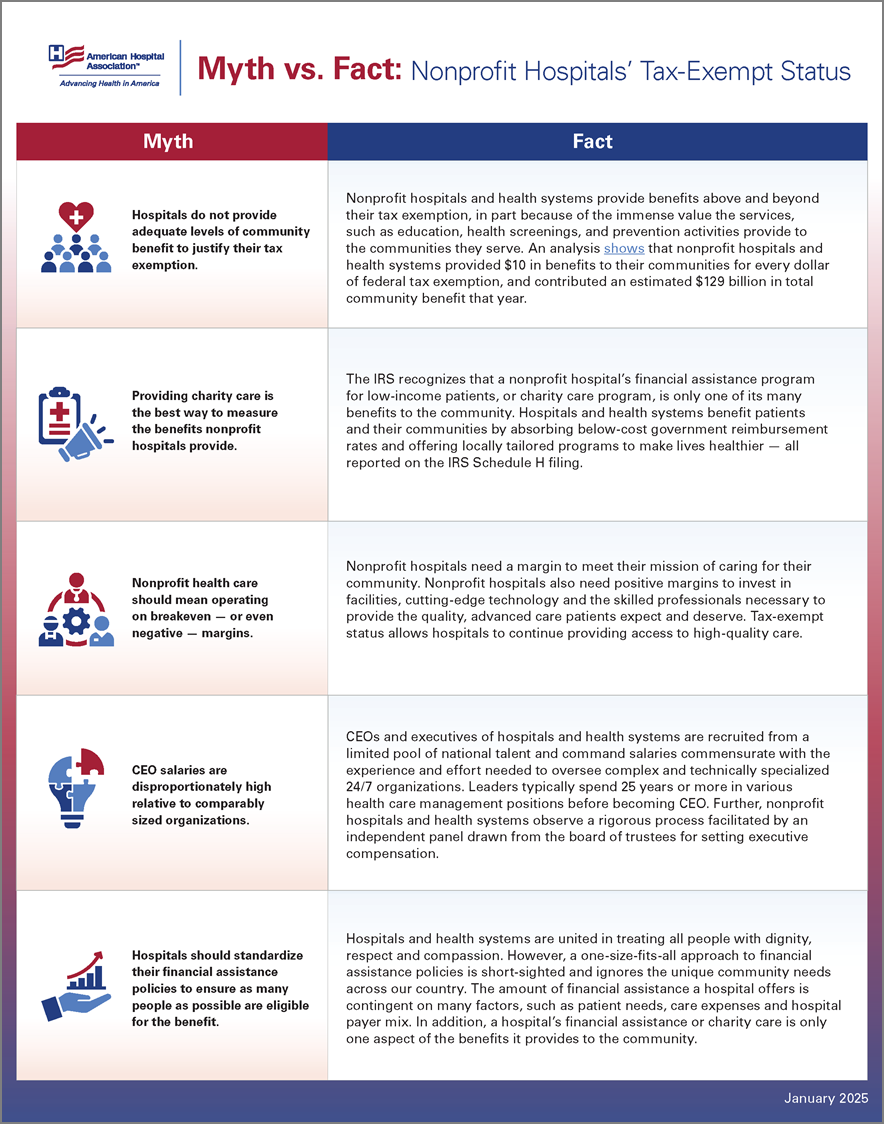

The mission of all hospitals and health systems, regardless of size and type of ownership, is to care for their patients and communities. In addition to providing financial assistance to those in need, hospitals have programs that are responsive to their community’s needs. These community benefits include help with housing, accessing healthy food, educational programs, health screenings, transportation to ensure patients arrive at needed medical appointments, vaccination clinics and other programs to address the many other needs that affect the community’s health and well-being.

Tax-exempt hospitals provided nearly $130 billion in total benefits to their communities in 2020 alone — the most recent year for which comprehensive data is available. This new report demonstrates that hospitals never retrenched during the pandemic, and, in fact, the amount of community benefit exceeded prior years by nearly $20 billion.