Automation, AI and Claims Management: The Future is Here

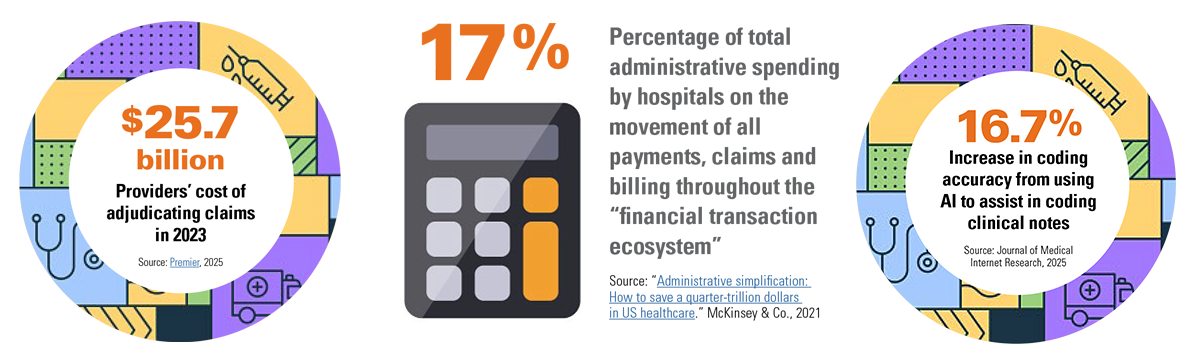

In a 2022 American Hospital Association (AHA) survey of nearly 800 hospitals, the hospitals collectively reported having $6.4 billion in delayed or unpaid claims that were at least six months old. Further, 95% of the hospitals stated they were spending more staff time andn resources on seeking prior authorization (PA) approval from health plans to avoid delayed or denied claims, with 84% indicating that compliance with health plan policies was becoming more expensive.

Three years later, the situation hasn’t improved. In the AHA’s “2025 Cost of Caring” report, the association stated, “Notably, 70% of denied claims were eventually paid, but only after multiple costly reviews. These burdens not only strain hospitals financially but also delay care and divert clinical staff from patient care.”

For a growing number of hospitals and health systems, industry experts say automation — specifically, automation of claims management by artificial intelligence (AI)-powered technology — can provide a solution to this challenging situation.

3 Questions to Anwer now

Hospitals and health systems that want to fix unnecessary claim denials and reclaim or recover lost revenue should consider these questions:

- Why automate revenue functions and tasks?

- Why use AI-powered technology to automate those revenue cycle functions and tasks?

- Why operate that technology on site rather than through a cloud-based solution?

How to Make Things Work

Generate savings through targeted claims management automations

Using technology to automate revenue cycle transactions can generate substantial savings for hospitals — savings that can be spent on direct patient care. That’s the big takeaway from the “2024 CAQH Index Report” released by the Council for Affordable Quality Healthcare in February 2025. CAQH’s latest annual report is based on 3 billion medical claims filed by 216 million health plan members involving 17 billion separate claim transactions.