Providers Boost Cybersecurity Spending in Wake of Change Healthcare Breach

Three-quarters of hospitals and health systems spent more on information technology last year and many will continue to do so, with greater focus on IT infrastructure and bolstering cybersecurity, notes a new report from Bain & Company and KLAS Research.

The findings are based on a survey of 150 provider organizations and payers across the U.S.

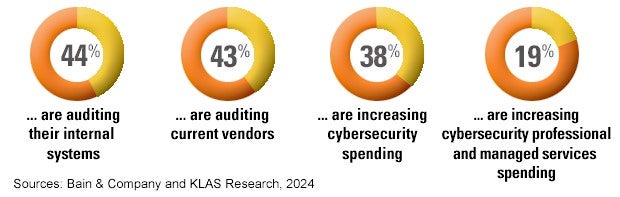

The greater attention being paid by many providers to hardening their cybersecurity defenses is a direct response to the February hack of payments manager Change Healthcare, the report states. That cyberattack, one of the largest in American history, has had a profound impact on U.S. hospitals and health systems. Ninety-four percent of AHA members reported suffering a financial impact from the event, with more than half saying the impact was “significant or serious.”

The incident also spurred many hospital boards to review single points of vulnerability within their IT stacks, with organizations allocating funds toward developing greater redundancy around critical systems, the report states.

The survey found the following in relation to providers’ responses to the Change Healthcare attack:

To learn more about ways to prevent and respond to cyberthreats, visit the AHA cybersecurity and risk advisory webpage.

Other categories of tech investments that stood out in the survey data include efforts to improve:

- Clinical workflow optimization.

- Data platforms and interoperability.

- Revenue-cycle management.

Providers who responded to the survey noted that they want to streamline processes, reduce administrative burden and increase utilization of labor, capital equipment and facilities. Data and analytics platforms also are receiving greater scrutiny, with many organizations recognizing that their data quality and governance are not robust enough to optimize the value of data-driven decision-making.

“The prospect of more powerful solutions enabled by artificial intelligence (AI) and machine learning has spurred a push to improve data quality to support clinical decision-making and nonclinical use cases, such as patient outreach and leakage prevention,” the report states.

Cost management, electronic health records integration and systems interoperability remain provider IT pain points. Providers cited costs as their biggest challenge in 2023 as well, highlighting a persistent problem.

AI Sees Greater Adoption

Providers are exploring AI-supported solutions to enhance decision-making, improve operational efficiency and deliver care. Yet only 15% of respondents say they have an AI strategy in place, compared with 5% in 2023. By way of comparison, about 25% of payers say they have an established AI strategy today.

Both types of organizations, meanwhile, say they are optimistic about implementing generative AI.

Providers have begun to pilot generative AI in clinical applications, including documentation and decision support tools, the report states. Early trials appear promising, suggesting that AI-powered tools may someday be able to analyze large volumes of data, identify patterns and trends, and generate actionable insights. Pilots around ambient clinical documentation have been particularly successful in reducing clinician administrative burden and improving the patient experience.