What Will It Take to Win the Consumerism Challenge?

If hospitals and health systems are to compete effectively in the battle for consumer loyalty with outside mega disruptors in outpatient care, they must bridge a widening gap between their organizational priorities and capabilities. This extends to all sorts of consumerism initiatives — from improving the customer experience to offering more convenient access to care to providing price transparency and using digital tools to engage consumers.

The rising bar of consumer expectations in these and other areas has left many health care executives uneasy about their current organizational capabilities. Findings from Kaufman Hall’s recently released fourth annual State of Consumerism in Health Care survey highlight these concerns, among others:

- Nearly 90% of health care executives believe their organizations are vulnerable to consumer-friendly offerings from non-hospital competitors.

- Roughly two out of three believe their organizations will face a “strong” or “extreme” competitive threat over the next five years from UnitedHealth Group/Optum or CVS Health/Aetna; 56% say the same about Amazon.

- Only 2% believe their organizations can provide a consumer digital experience comparable to that of Amazon.

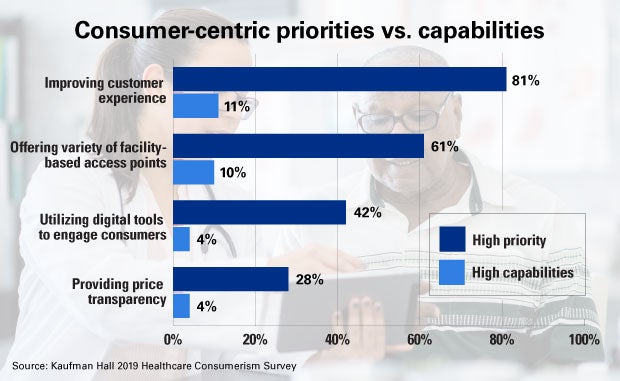

The consumerism conundrum for health care leaders is further revealed when examining organizational priorities and capabilities. More than 80% of health care executives rank improving the customer experience as a high priority while only 11% believe their organizations have high capabilities in this area. The gap between high priorities and high capabilities is similar in other areas, including employing digital tools to engage consumers, using consumer learning to guide strategy and offering a variety of access points to virtual care.

And while many legacy providers are making a concerted effort to meet consumer demands, Kaufman Hall’s consumerism ratings show that only 8% are considered “best in class” — defined as having a dedicated focus and resources to build a consumer-centric infrastructure, offering a strong consumer experience, strategic pricing and price transparency. About one in four are taking a “thoughtful approach” to consumerism by investing in infrastructure and initiatives that are being expanded systemwide. The remainder are either still planning their consumerism strategy (39%) or lack one entirely (29%).

As for how to respond in this environment, Kaufman Hall urges providers to expand virtual-access initiatives and use digital tools to streamline care and improve patient satisfaction and engagement. Wide-scale adoption of real-time consumer experience products, which would allow providers to address patient needs as they occur, also would help, the report notes.

In the end, many providers may opt to partner with their larger retail and technology competitors to build a more consumer-centric hospital or health system. Keith Figlioli, general partner at the health care venture firm LRVHealth, recently told Healthcare Dive that he expects “massive proliferation of partnership announcements” over the next five to 10 years as providers vie for position along large distribution chains.

Figlioli encourages health systems to think first about long-term viability beyond digital access points and telehealth and to develop partnership models with new entrants on a local level to keep up with traditional competitors.

For more on how to lead the charge for disruptive innovation, read this AHA Market Insights report.