Innovation Efforts Get More Targeted as Budgets Tighten

COVID-19 may be stifling normal operations around the country, but it isn’t stopping targeted innovation efforts with strong ROI potential to cut care delivery costs. In fact, 15 of 20 prominent health systems recently surveyed are actively pursuing commercial relationships with health tech startups. And most of these efforts are aimed at finding compelling non-COVID-19 use cases that can be deployed immediately.

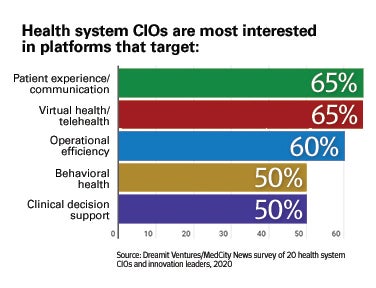

The survey, conducted jointly by venture fund Dreamit Ventures and MedCity News, found that responding chief information officers and innovation leaders are looking for platforms to solve urgent challenges that existed long before the pandemic.

Top priorities for respondents from large health systems include telehealth, patient engagement/communication and operational efficiency, followed by behavioral health, clinical decision support and revenue cycle management. Only one in five said they were looking solely for pandemic solutions, perhaps indicating that respondents feel they have the infrastructure in place to manage their response to the virus.

Respondents made it clear, however, that budgets for innovation efforts have been constrained or frozen and that go-forward partnerships must have strongly defensible ROI potential — a reflection of the billions of dollars in losses provider organizations have suffered because elective procedures were postponed due to the pandemic.

Respondents made it clear, however, that budgets for innovation efforts have been constrained or frozen and that go-forward partnerships must have strongly defensible ROI potential — a reflection of the billions of dollars in losses provider organizations have suffered because elective procedures were postponed due to the pandemic.

In this tighter economic environment, health systems will be screening startups more closely, and startups must come prepared to clearly articulate and demonstrate the cost-cutting potential for their solutions, respondents noted.

Eighty-five percent of the responses came from health systems with more than 1,000 beds, including organizations like Kaiser Permanente, Duke University, Houston Methodist Hospital, Thomas Jefferson and St. Luke’s University Health Network. And, in spite of the significant challenges large providers face, the survey findings show optimism for continuing to advance innovation, with 95% saying they’re engaging in new partnerships during the pandemic.

4 Takeaways for the Future of Health Innovation

Keep Pushing on Innovation

Even though views varied widely on when budgets would return to pre-pandemic levels, nearly all respondents continue to pursue partnerships that can drive greater efficiency throughout their organizations. That’s a positive sign and one the entire field must emulate in this precarious financial environment.

Expanded Telehealth Is Here to Stay

Two-thirds of health systems felt they would increase or maintain current levels of telehealth activity beyond the pandemic, while 30% predict a slight shift back toward in-person visits. The new normal will continue the reliance on digital technology as more patients begin to enter the hospital for face-to-face visits, with a percentage of the population preferring virtual visits. This evolution of a hybrid model of care will unfold with the goal of well-integrated care and a seamless digital interface.

Raise the Bar on Startups

With tighter budgets, responding organizations are demanding more of startups in demonstrating value and ROI for their solutions. That’s a necessity and something all provider organizations will have to do when allocating precious strategic capital.

Remain Laser-Focused on Cost

Hospitals and health systems face unprecedented challenges with COVID-19, but leaders can’t take their eye off the ball of cost reduction or the value of partnerships and emerging technologies to achieve this aim. Cost-effective care delivery will only receive more attention from government leaders when the pandemic subsides, the election is over and legislators once again explore ways to reduce health care expenditures.