What It Takes to Create Disproportionate Value in Challenging Times

A complicated set of factors involving governmental and private-sector spending on health care will bring about significant changes over the next several years that will effectively flatten reimbursement levels, even as demand for services is expected to keep growing. While that’s generally bad news for providers, those who develop innovative new business models can create disproportionate value in this challenging market, notes a recent McKinsey & Co. analysis.

The formula for success varies across service lines, but common among these new models is alignment of incentives — better care integration and use of data and advanced analytics — typically involving risk bearing. Hospitals and health systems pursuing diversified business models that include a broader range of care delivery assets (e.g., physician practices, ambulatory surgery centers and urgent care settings) are generating returns above expectations.

Providers that offer diverse settings of care also have been able to reduce costs, improve care coordination and patient experience while maintaining or enhancing quality. They often demonstrate the ability to ensure referral integrity and leverage scale to drive success, particularly in systems with greater market share.

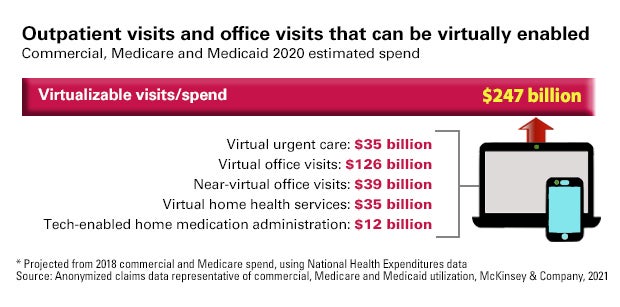

Technology, especially telehealth, will play a pivotal role in new care models. About $250 billion of all Medicare, Medicaid and commercial outpatient, office and home health care spend could be virtualized, including 35% of home health visits and 24% of office visit/outpatient encounters, notes a May 2020 McKinsey report.

But with this increased efficiency and easier-to-access care, providers will face some challenges, not the least of which is how a rise in virtual visits may lead to a reduction of in-person visits. This has significant implications for providers with large, expensive facilities to operate.

In some market segments, innovation and integration are driving change through greater use of data and analytics, better utilization management, network management and clinical information systems. Areas like behavioral health and social determinants of health have benefited from advanced data and analytics.

Provider organizations that can effectively integrate new and existing technologies into their operations can create sustainable business models to generate greater value.

This will require more than simply aligning with health care’s growth segments. The ability to innovate at scale will be a differentiator.

5 Business Innovation Questions for Leaders

- How does our business model need to change to create value in the future health care world?

- How does our resource allocation approach need to change to ensure the sustainability of the future business model, so it’s funded (whether with capital or staffing) differently than our legacy business?

- How can we rewire our organization to innovate more quickly?

- How can our business model identify and take advantage of broader market innovations that can be adapted to our system? What partners will we need?

- How will we prepare our broader organization to adopt and scale new innovations?