Full Speed Ahead for Risk-Based Contracts? Maybe Not

The days of shared-risk, value-based contracts (VBC) dominating health care are seemingly just around the corner. But that reality may not materialize as quickly as some envision, based on results of the 9th Annual Industry Pulse Survey recently released by Change Healthcare and the HealthCare Executive Group.

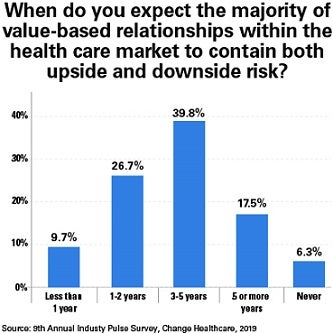

The survey found that nearly two-thirds of responding hospital leaders, third-party administrators, health plan executives, academics and other stakeholders believe that VBC won’t be dominant for another three to five years or more. And 6 percent believe that it will never happen.

What’s hindering progress? Respondents cited obstacles like limitations in data sharing; no agreement on outcome measures; and a lack of incentives for payer and providers to work together. All of this has left health care leaders feeling unable to tackle the challenges of implementing and managing these contracts, the report concludes.

Making rapid change on such a large scale also may be an impediment, with the report noting that VBC will require major changes in business models — beyond simply operationalizing the steps from concept to contract to claims processing. A new AHA Market Insights report Evolving Models of Care delves much deeper into the successes and challenges providers face in aligning care delivery models with emerging payment models.

Making rapid change on such a large scale also may be an impediment, with the report noting that VBC will require major changes in business models — beyond simply operationalizing the steps from concept to contract to claims processing. A new AHA Market Insights report Evolving Models of Care delves much deeper into the successes and challenges providers face in aligning care delivery models with emerging payment models.

The Pulse Survey also explored ways that payers can more effectively support providers in facilitating high-value care. Standardizing quality and outcome measures was the most common suggestion, cited by 28 percent of the respondents, followed by co-developing payer-provider risk-management programs (22.6 percent), sharing performance data (14 percent) and co-developing bundled payments around episodes of care. ms_052119_item1_chart-03_v2.jpg

Pulse Survey respondents plan to take actions within 12 months to address nonmedical barriers to care. These are the top five:

- Care coordination: Slightly less than two-thirds of respondents will work to better coordinate care.

- Transportation: Nearly 40 percent of organizations plan to make it easier for patients to get to their appointments. A growing number of providers nationally are working with Lyft and Uber to transport patients to doctor visits and hospitals, helping to avoid the costs of delayed or missed care.

- Food insecurity/access: More than one in four respondents will address this social determinant of health. App-based food delivery services are a promising tool to fight the health hazards of food insecurity.

- Benefits coordination: Twenty-three percent will work to improve benefits coordination to help qualified patients receive public assistance.

- Social isolation: Nearly one in five respondents will address this area of care, which is gaining attention, because loneliness and isolation can exacerbate health problems, increase mortality and lead to higher costs.