On-demand Virtual Care Is Rising . . . and So Are Consumer Expectations

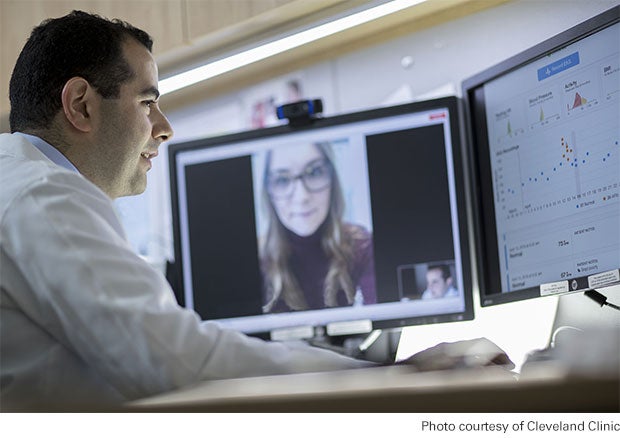

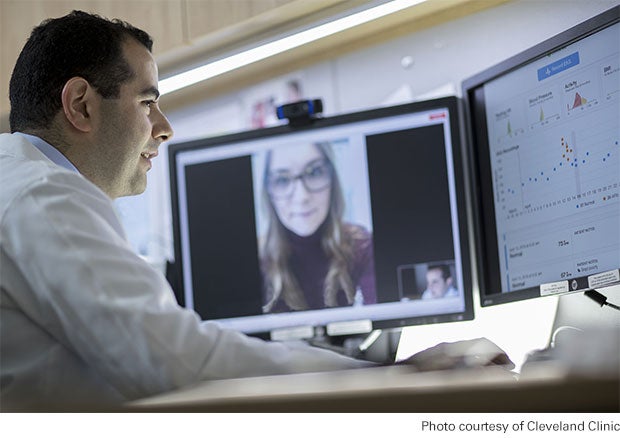

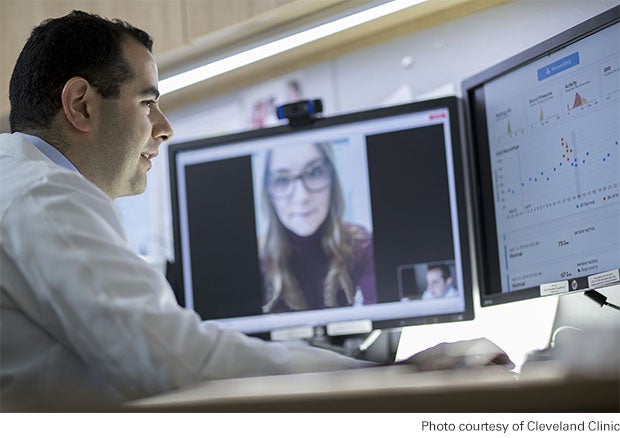

The direct-to-consumer (DTC) telehealth market is growing rapidly, and hospitals and health systems that are developing their own platforms for these services should brace for stiff competition and rising consumer expectations for a broader array of virtual care options. That became even more evident with the recent news that Cleveland Clinic and telehealth company American Well will launch a joint venture to give national and global access to consultative services from some of the provider’s specialists.

The venture, named The Clinic, is still in its early stages and the partners haven’t yet provided details on which medical specialties will be included in their services or how the offering will address such issues as fees, reimbursement, licensure requirements across state lines or how specialists will connect with electronic health records. But this much is clear: The initiative is one of the first large-scale attempts to broaden virtual care consultations beyond urgent care.

American Well and Cleveland Clinic say they’re focused on leading the field toward integrated care models that complement and connect to traditional care settings. They hope to transform virtual care to a more proactive model in which experts come to patients as they’re needed in a way that gives more consumers access to the best minds in medicine.

The two organizations have been working together since a 2014 deal that allowed Cleveland Clinic to use American Well to deliver urgent care. But while Cleveland Clinic and many other provider organizations have seen a rapid rise in the number of virtual visits, the overall percentage of care delivered via telehealth remains low.

Still, care delivery through telehealth platforms is expected to grow. Employers and payers are increasingly encouraging patient use of telehealth services. Case in point: The nation’s largest private payer, UnitedHealth, recently launched a new virtual care app for the more than 27 million Americans covered in its employer-sponsored health plans.

The app, which will be free for most people enrolled in UnitedHealth employer-sponsored plans, gives users access to practitioners via mobile devices or computers. Consumers may have to pay out-of-pocket costs for telemedicine services depending on their plan and state requirements. Walmart — through a partnership with Doctor On Demand, Grand Rounds and HealthSCOPE Benefits — also recently expanded its telehealth services for employees in selected markets. For $4 per visit, employees can use a virtual platform that includes online and video visits.

These and other moves to make DTC telehealth services more accessible also mean more competition for hospitals and health systems launching their own DTC telehealth services. Providers with their own DTC telehealth platforms and services will need to demonstrate a unique value proposition to stand out from similar services offered by a patient’s employer or payer, or other health systems. And as more and more Americans use these platforms, expectation levels will rise for factors like platform ease of use, wait times to connect with a practitioner, scope of services, etc. The question for hospitals and health systems will be: Are we positioned to compete effectively in this market?

To learn more about how hospitals and health systems can plan strategies in this area, download the Market Insights report “Telehealth: A Path to Virtual Integrated Care” from the AHA Center for Health Innovation.