Hospitals Make Progress on Value-Based Payment Models

Payers and providers don’t always move at the same pace or have the same priorities when it comes to transforming health care. And if results from a new national survey are any indication, payers and providers are on somewhat divergent paths on key issues like embracing value-based care payment models and how they see their roles in meeting rising consumer expectations.

The 2020 Industry Pulse Report from Change Healthcare, a technology company that provides data and analytics solutions to improve clinical and financial outcomes, found payers were far more likely than providers to have migrated to value-based care strategies. The survey drew from a sample of 445 respondents — health care payers, providers and third-party vendor organizations — but illustrates some key issues about work remaining on these important issues.

For instance, 62% of payers and 43% of providers say they are participating in alternative payment models linked to quality. Payers also are far more likely to report full capitation use — 9% vs. only 2% of providers. The parties also don’t align on whether payers should standardize cost and quality data to orchestrate high-value care, with providers nearly twice as likely to support this notion as payers.

Further illustrating the divide on value-based care adoption, 43% of providers say they derive less than 10% of their revenue from these payment models vs. 21% of payers. As for what’s hindering progress in this area, providers and payers see things differently. Providers are far more likely to cite unclear or conflicting performance measures and regulatory/political uncertainty as an impediment to value-based care while payers are significantly more likely to cite their lack of or limited IT infrastructure.

Priya Bathija, vice president of the AHA’s Value Initiative, says the Change Healthcare survey data don’t adequately reflect the level of progress provider organizations are making in embracing value-based care models.

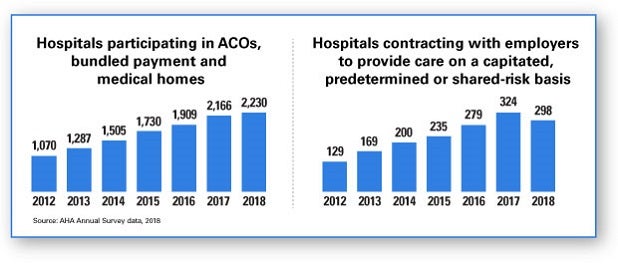

“AHA’s Annual Survey data [based on a far larger sample size] show that a higher percentage of providers are participating in alternative payment models,” Bathija says. AHA Annual Survey data for 2018 show that 53% of community hospitals participate in an ACO. “The number of hospitals participating in accountable care organizations, bundled payment programs or medical homes has increased steadily since 2012. In addition, more hospitals are taking on risk in a number of ways,” she adds.

For example, more hospitals are contracting directly with employers to provide care on a capitated, predetermined or shared-risk basis. In addition, an increasing number of hospitals are contracting with commercial payers to connect payment to performance on quality or safety metrics, Bathija says.

In addition to the barriers noted in the Change Healthcare survey, Bathija says that providers need to build cultures that support value-based care delivery and ultimately the move to value-based payment models. Examples include providing a climate that promotes delivery of high-quality care at a lower cost for patients, and discussing value with hospital and health system board members, patients and families.

Providers and payers are similarly on different tracks regarding how they’re responding to the consumerization of health care. Payers are more likely to have robust consumer-centric strategies, survey data show.

While a small minority of providers (18%) and payers (24%) report having a consumer-centric strategy in place, 14% of providers report having no strategy and 34% say their strategy is in its earliest stages. In comparison, all payer respondents say they either have a consumer-centric strategy in place or have one in development.

Providers and payers also are sharply divided on which group is more suited to provide consumers with cost and quality data. Nearly three quarters of payers feel they are better positioned to provide this information, especially in sharing government-driven ratings, while 42% of providers believe they are better positioned in this area, particularly when it comes to patient satisfaction scores and consumer reviews. The divide was much narrower on health outcomes data, with 49% of providers and 42% of payers saying they are more likely to deliver this information to consumers.