A Fresh Perspective on Where Telehealth Growth Will Settle

You may recall that about a year ago — during the height of the pandemic — McKinsey & Company issued a startling projection that as much as $250 billion of U.S. health care could become virtualized. That seemed like a bold forecast at the time, but will it come true?

Much of it already has, according to a recently issued follow-up analysis. The new McKinsey report notes that two-thirds of the office visits and outpatient care that they forecasted would be delivered virtually are now being delivered that way.

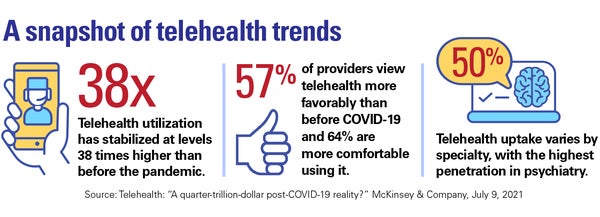

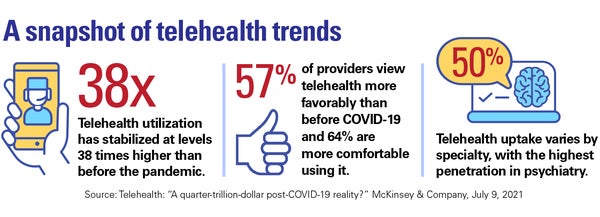

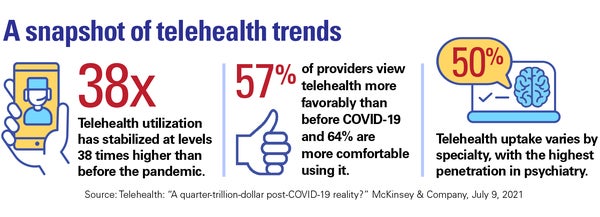

Putting the soaring growth in virtual care into perspective, the report notes that overall telehealth use has stabilized at 38 times higher than before COVID-19 hit, ranging from 13% to 17% of visits across all specialties and remaining steady since June 2020. Other highlights from the analysis include:

- About 40% of consumers said they plan to continue using telehealth, up from 11% before the pandemic.

- Between 40% and 60% of consumers want a broader set of virtual care solutions, such as a “digital front door” or lower-cost virtual health plan.

- On the provider side, as of April 2021, 84% of physicians were offering virtual visits and 57% prefer to continue offering these services.

- Telehealth uptake varies significantly by specialty, with the highest penetration in psychiatry (50%) and substance-use treatment (30%).

Despite signs that dramatically higher telehealth levels may be here to stay, there’s room for caution about the future and whether McKinsey’s projection that $250 billion in care could become virtualized. For starters, the future of telehealth reimbursement once the public health emergency ends is not yet clear. And physicians surveyed clearly indicated that they want parity in reimbursement whether care is delivered in person or virtually — 54% said they would not offer virtual care at a 15% discount to in-person care. Likewise, uncertainty remains about the future regulatory environment for telehealth.