Assessing the Impact of COVID-19 on Rural Hospitals

An AHA Research Brief prepared by faculty at the Virginia Commonwealth University College of Health Professions, Department of Health Administration:

Saleema A. Karim, Ph.D. | Nathan W. Carroll, Ph.D. | Paula H. Song, Ph.D. | Adam Atherly, Ph.D.

Key Findings

- Approximately half (48%) of rural hospitals consistently experienced negative operating margins from patient services prior to and during the COVID-19 pandemic.

- A small minority (12%) of rural hospitals consistently experienced positive operating margins prior to and during the COVID-19 pandemic.

- The COVID-19 provider relief funds benefited all rural hospitals, however rural hospitals with negative total margins had the greatest benefit, with overall increases to profitability.

- In 2021, COVID-19 provider relief funds masked long-standing financial challenges experienced by many rural hospitals.

- System membership may provide benefits to rural hospitals in terms of supporting operations and navigating regulatory and financial challenges during the COVID-19 pandemic.

Purpose

The purpose of this research is to examine the impact of the COVID-19 pandemic on rural hospital financial performance. The results of this study will provide rural hospital leaders a better understanding of the impact of the COVID-19 pandemic on rural hospital operational and financial performance. Results will also assist policy makers seeking to understand the impact of provider relief funds on rural hospital financial performance.

Background

The COVID-19 pandemic created financial and operating challenges for hospitals across the country. These challenges may have been particularly severe for rural hospitals since, prior to COVID-19, rural hospitals were already struggling with shrinking margins, declining volumes, workforce challenges and other barriers to providing care. The COVID-19 pandemic caused a rapid series of changes for rural hospitals, with the potential to cause drastic swings in the ways rural hospitals provide care to their communities. Moreover, the effects of these changes are likely to shift over time since the intensity of revenue pressures (like limits on elective surgeries) and expense pressures (like unusually high staffing costs) changed throughout the course of the pandemic. The availability of financial aid varied throughout the course of the pandemic as well. Most provider relief funds and other financial support were available to hospitals between 2020 and 2021 and have not continued beyond that time. COVID-19’s effects are also unlikely uniform given the variation in rural hospitals’ revenue sources (i.e., the degree to which they depend on revenues from patient care, investment returns or special COVID-19 pandemic funding), variation in prior financial performance and other determinants. Rural hospital financial performance is multifaceted and is influenced by both hospital and community characteristics. Hospital characteristics such as ownership, size and system affiliation may be important determinants of financial performance. System membership in particular may benefit rural hospitals in a variety of ways, by supporting rural hospitals in maintaining efficient operations and by helping rural hospitals navigate the particular regulatory and financial challenges that COVID-19 posed.

Data and Methods

This study used hospital-level data from 2017 to 2022. Data were obtained from the Medicare Hospital Cost Reports, the AHA Annual Survey, the Area Health Resource File, the Center for Disease Control and Prevention and the Kaiser Family Foundation. Data were merged using a unique hospital provider ID and a year identifier. Hospitals differed in the annual start and end dates of their reporting years. Some hospitals’ start and end dates aligned with the calendar year while other hospitals used a different fiscal year. We recorded hospital financial observations based on cost reporting year of the hospital’s data. For instance, hospital data appearing on the 2020 cost report file were recorded as 2020, even if the hospital’s reporting year ran from March 1, 2020, to Feb. 28, 2021.

Rural hospitals were defined as acute care general hospitals located in non-metropolitan counties (micropolitan and non-care-based counties) and Eligible Census Tracts in Metropolitan Counties. The sample consisted of 2,246 rural hospitals (12,256 rural hospital years). Rural hospitals with profitability margins in less than the 1st percentile and greater than the 99th percentile were excluded from the analysis and rural hospitals with reporting periods of less than 360 days were also excluded from the analysis.

We identified four measures of operating margin which differed according to the revenue types included in each. These measures were:

- Patient care margin, which only includes revenues from patient care activities.

- Operating margin, which includes revenue from patient care activities as well as other operating revenue (e.g., gift shop, cafeteria, tuition).

- Total margin, which includes all operating sources of revenue plus investment returns, donations and non-COVID-19 related government appropriations.

- Total margin with public health emergency (PHE) funds, includes all sources of revenue and PHE funds.

To understand the variation in hospitals’ financial performance, we created three groups of hospitals based on their financial strength as measured by patient care margins from 2017- 2022. These groups include:

- Hospitals with positive margins in each year of the study period.

- Hospitals with negative margins in each year of the study period.

- Hospitals with a mix of positive and negative margins during the study period.

Results

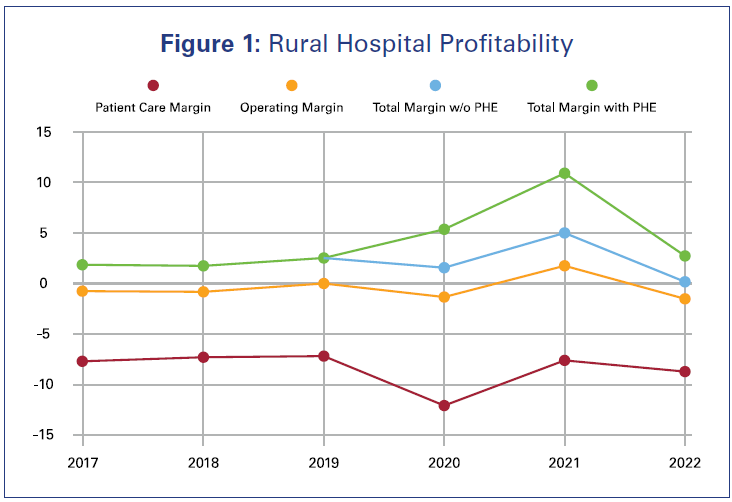

Profitability Trends from 2017-2022: 2021 Was a Positive Outlier for Most Rural Hospitals

Figure 1 shows mean hospital margins for the three years prior to the COVID-19 pandemic through 2022. Prior to the pandemic, the cost of providing care to rural patients exceeded reimbursement rates, resulting in negative patient care margins. However, rural hospitals lost money on patient care, but relied on other sources of income, including donations, non-COVID-19 government appropriations, and revenue from cafeteria and gift shop sales, to earn small, positive total margins on average. In 2020, hospital total, operating and patient care margins declined. Hospital financial margins in 2021 saw increases in all measures. However, these were followed by steep declines in 2022 as all margin measures fell below pre-pandemic levels.

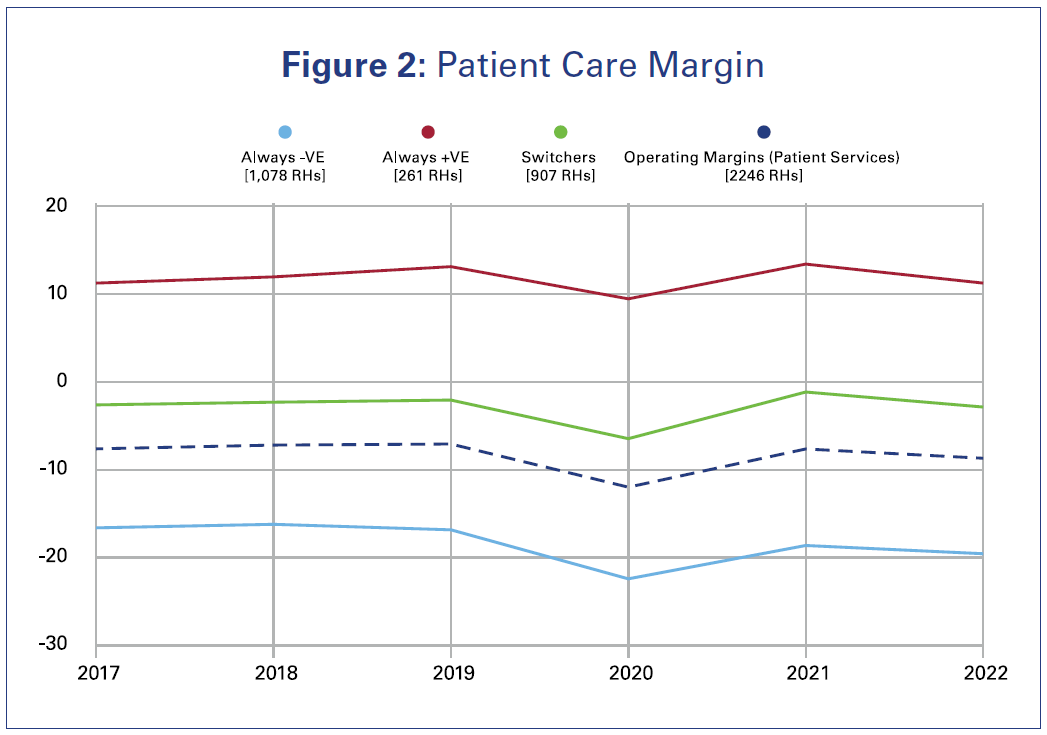

In addition to the variation from year to year, hospital financial performance showed notable variation from the average levels shown in Figure 1. To investigate this variation, we divided hospitals into three groups based on their patient care margins over the course of the study period. These groups included a “positive margin” group of hospitals whose patient care margins were positive in each year of the study period, a “negative margin” group of hospitals whose patient care margins were negative in each year of the study period, and a “mixed” group whose patient care margins were positive in some years and negative in others. Notably, 48% of the organizations in our sample (1,078 hospitals) had negative margins from patient care every year. Forty-percent of the sample (907 hospitals) had a mix of positive and negative margins throughout the study period. Only 12% of our sample of rural hospitals (261 organizations) had positive patient care margins each year of the sample.

Figure 2 presents the performance of each group of hospitals by year. The operating margins from patient services for both the persistent negative margin group and the group with mixed performance were consistently negative. Interestingly, even though the group with mixed performance contained hospitals with positive margins in some years and negative margins in others. The frequency and magnitude of the negative margins in this group were large enough to give the group as a whole a negative average operating margin from patient services in all years of the sample. A small number of rural hospitals experienced positive operating margins from patient services.

Characteristics of Hospitals with Consistent Positive Margins from Patient Care

Our analysis identified several ways that hospitals with persistent positive margins differed from hospitals in the mixed and negative margin groups (Table 1). Hospitals in the positive margin group had a smaller share of discharges coming from Medicare and Medicaid patients. Hospitals in the positive margin group were also more likely to be affiliated with systems — 83% of hospitals in the positive margin group were system members compared to 60% and 37% of the mixed and negative margin groups respectively. Finally, positive margin hospitals were more likely to be for-profit, have a larger average bed size, have lower average length of stay and have lower operating expenses.

Table 1: Rural Hospital Characteristics by Financial Performance Group

| Always negative patient care margins | Mixed patient care margins | Always positive patient care margins | |

|---|---|---|---|

| Percent of sample | 48% | 40% | 12% |

| Percent Medicare discharges | 50.5% | 45.2% | 40.3% |

| Percent Medicaid discharges | 9.1% | 9.3% | 8.6% |

| Percent of group hospitals affiliated with a system | 36.6% | 60.3% | 82.8% |

| Percent of group hospitals with for-profit ownership | 6.1% | 10.1% | 23.8% |

| Mean bed size | 39.6 | 46.2 | 63.5 |

| Average length of stay (days) | 15.0 | 18.5 | 7.1 |

| Mean operating expense per inpatient day | $14,424 | $21,581 | $13,098 |

COVID-19 Relief Funds Contributed to Positive Margins in Many, but Not All, Rural Hospitals

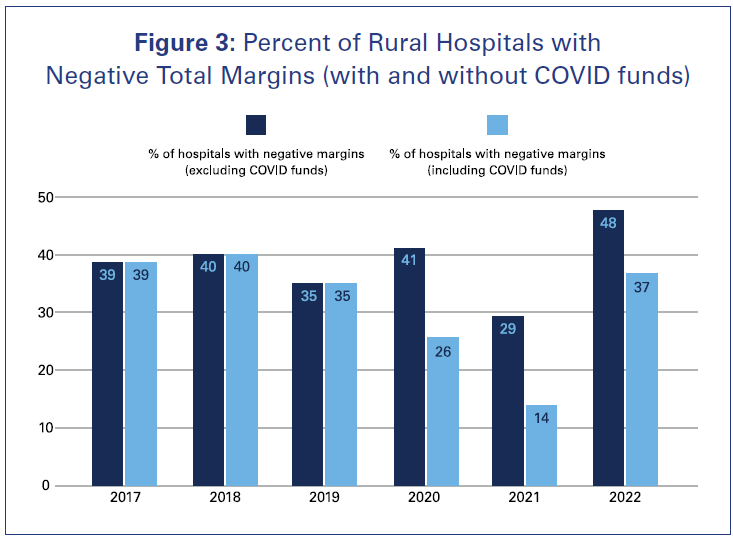

Figure 3 shows the percent of rural hospitals in our sample with negative total margins, annually, from 2017-2022. The bars represent the percent of hospitals with negative total margins, both with and without COVID-19 relief funds.

Prior to the pandemic, COVID-19 relief funds were clearly unavailable, so the two bars are equal. However, it is notable that even in the pre-pandemic period, between 35% and 40% of rural hospitals had negative total margins. During the pandemic, COVID-19 relief funds were successful in providing financial support to help hospitals cope with declining volumes and other financial challenges. For instance, in 2020, excluding relief funds, 41% of rural hospitals would have reported negative total margins. However, 26% of rural hospitals incurred losses after accounting for the supplemental COVID-19 relief funds. Relief funds continued to supplement hospital financial margins through 2022.

COVID-19 Relief Funds Caused the Largest Increases in Total Margin for Hospitals That Would Have Experienced Losses

Table 2 presents the average total margins for rural hospitals with and without the COVID-19 relief funds from 2020-2022. The COVID-19 relief funds increased the total margin for all hospitals.

- For some rural hospitals with negative (-) total margins, COVID-19 relief funds resulted in margins that were still negative, but less so. These rural hospitals experienced 2.59% point increase after the inclusion of COVID-19 relief funds. Among these hospitals, the total margin increased from -10.44% to -7.85%.

- For other rural hospitals with negative (-) total margins, COVID-19 relief funds fully covered the cost of providing care and resulted in positive (+) margins. Among these hospitals, total margin increased 12.42% points after the inclusion of COVID-19 relief funds. The total margin increased from -5.52% to 6.90%.

- COVID-19 relief funds increased the margins of some hospitals that would have had positive margins without the relief funds. However, margin increases among this group were relatively small. This group of rural hospitals experienced a margin increase of 2.65% points after the inclusion of the COVID-19 relief funds. Their total margin increased from 9.64 to 12.28%.

Table 2. Average Total Margins for Rural Hospitals With and Without the COVID-19 Relief Funds (2020-2022)

| Average total margins without COVID-19 PHE funds | Average total margins with COVID-19 PHE funds | Absolute change in total margin | |

|---|---|---|---|

| Negative Total Margin (-) | -10.44% | -7.85% | ⇧ 2.59% |

| -5.52% | 6.90% | ⇧ 12.42% | |

| Positive Total Margin (+) | 9.64% | 12.28% | ⇧ 2.64% |

Discussion

At the outset of the pandemic, there was particular concern that hospitals would not have the financial resources needed to address the challenges posed by the COVID-19 pandemic. Our results show that the worst fears about hospital financial conditions were avoided, in part due to the rapid distribution of COVID-19 provider relief funds. The majority of these funds, and other forms of financial aid, were distributed to hospitals during 2020 and 2021 (though some fund distributions still impacted hospitals’ 2022 reporting years). As a result, the percentage of rural hospitals incurring losses was between 11 and 15 percentage points lower than it would have been between 2020 and 2022. Moreover, in 2020 and 2021, the percent of rural hospitals with negative margins dropped below pre-pandemic levels.

Unfortunately, these benefits did not accrue to all groups of rural hospitals during the pandemic period. Almost half of rural hospitals experienced negative margins from patient care both before the pandemic, in 2020, and in each year after. Moreover, total margins in 2022, the most recent year of data available, have declined. When provider relief funds are excluded from margins, the average total margin for all groups of hospitals is lower than it was in any year of our sample.

Our analysis of hospitals with persistent negative margins from patient care, persistent positive margins from patient care and mixed margins revealed that these groups differ in important ways. The hospitals that struggled financially during the study period had higher volumes of Medicare and Medicaid patients. They were also smaller and less likely to be affiliated with a hospital system. The fact that the most financially vulnerable rural hospitals share similar characteristics suggests that these providers may require unique strategies or policy interventions to remain financially viable.

Overall, our results suggest that relief funds provided much needed support to rural hospitals, and in addition to addressing the financial needs stemming from the COVID-19 pandemic, these funds were able to provide a measure of relief to many rural hospitals from long-standing financial pressures. However, these observations raise questions about how rural hospitals will cope financially as COVID-19 funding has ended but persistent financial challenges remain.

Conclusion

Provider relief funds were successful in preventing financial losses for many hospitals during the pandemic and, in some cases, contributed to positive hospital margins in 2021. However, as this funding declined in 2022, and hospitals faced persistent, and in some cases worsening, financial challenges, margins dropped. This decline is especially concerning for the large percentage of hospitals that struggled financially even prior to the pandemic. Rural hospitals that were part of hospital systems were perhaps able to mitigate the financial effects of the pandemic. Hospital systems may be able to provide aid to rural hospitals, navigate the operational and regulatory challenges that came with the COVID-19 pandemic and provide efficiencies in those operations.