Fact Sheet: Expiration of the Enhanced Premium Tax Credits

February 2025

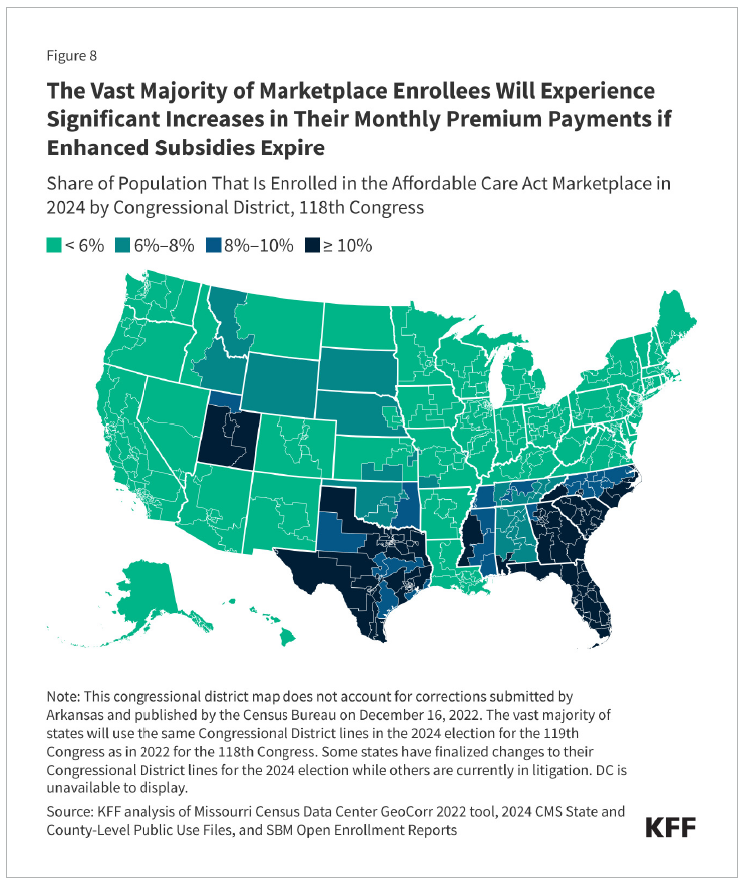

Individuals and families in rural communities would see biggest disruptions

The Issue

In 2021, Congress expanded eligibility for enhanced premium tax credits (EPTCs or tax credits) to help certain individuals and families purchase insurance on the health insurance marketplaces. This change has been especially impactful for those in rural areas, who tend to face higher premiums and fewer coverage options,1 as well as those with lower incomes.

These EPTCs are scheduled to expire at the end of 2025. If they are not extended, millions of Americans will lose coverage or incur significantly higher costs. The largest disruptions would be felt by individuals and families living in rural communities that have experienced significant benefits from the expanded health care coverage.

AHA Take

In order to continue the life-saving care to rural and low-income patients, as well as the stability of the entire health care system, the AHA urges Congress to extend the EPTCs.

Why?

- The EPTCs helped millions of Americans purchase affordable commercial health care coverage and access necessary health care. The expiration of this policy would both harm the health of communities and raise individuals’ taxes via premium increases.2

- Analysis by KNG Consulting for the AHA shows that the expiration of the EPTCs would disproportionately affect those in rural areas and those with lower incomes. Specifically, the most rural states in America would experience, on average, a 30% decrease in marketplace coverage and a 37% increase in their uninsured populations.3

- Rural populations have more complex health needs, experience higher average health insurance premiums, are much more likely to be uninsured, face longer travel distances to providers and have fewer health care options. The EPTCs are a fundamental support for critical health care access in rural communities nationwide.

- Individuals with lower incomes and less formal education also face greater health vulnerabilities due to higher rates of chronic conditions and financial barriers to receiving timely care. The expiration of the EPTCs would exacerbate these existing health care comorbidities and access challenges.

- Rural states would see higher rates of disruption in coverage, with larger percentages of residents losing marketplace coverage and becoming uninsured. These disruptions are particularly high in rural states that have not expanded Medicaid.

1 americanscovered.org/big-for-farm-states-why-enhanced-premium-tax-credits-are-essential-for-rural-americans /.

2 kff.org/affordable-care-act/issue-brief/inflation-reduction-act-health-insurance-subsidies-what-is-their-impact-and-what-would-happenif-they-expire/.

3 Calculated as the average percent impact on coverage for the most rural states in the United States, as of 2024. See World Population Review, State Rankings, Most Rural States 2024,” at worldpopulationreview.com/state-rankings/most-rural-states.