340B Hospital Community Benefit Analysis - September 2025

In 2022 Alone, 340B Tax-exempt Hospitals Provided Nearly $100 Billion in Total Benefits to Their Communities

Improving the health of their communities is at the heart of every hospital’s mission.

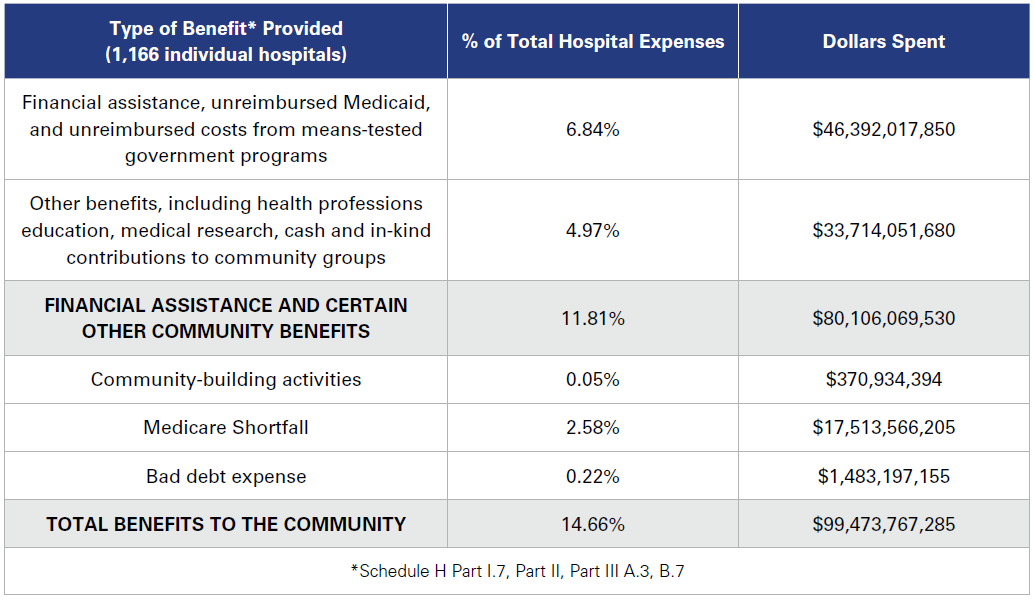

Tax-exempt hospitals annually demonstrate accountability to the communities they serve by reporting to the Internal Revenue Service (IRS) on the benefits they provide to their community. The IRS collects this information using Form 990 Schedule H and makes it publicly available. In 2022, the most recent year for which this data is available, tax-exempt hospitals participating in the 340B Drug Pricing Program provided nearly $100 billion in total benefits to their communities, a nearly $32 billion (47%) increase from 2019, even during the ongoing recovery from an unprecedented pandemic.

340B Drug Pricing Program

Congress created the 340B program to help those hospitals serving vulnerable communities stretch scarce federal resources as far as possible to maintain, improve, and expand access to essential services for their communities. Funded solely by discounts provided by drug companies, not taxpayer dollars, the 340B program is a lifeline for participating hospitals and the communities they serve.

For example, Johnson County Hospital in Nebraska has created many important programs with the support of 340B savings. These include home health services in the community to help patients manage chronic conditions and transportation assistance to medical appointments to patients without access to public transit. Grady Health System in Georgia uses 340B savings to offer discounted outpatient drugs to low-income patients and has opened several neighborhood health centers to expand access to primary care in areas with significant need. Adirondack Health in New York leverages 340B savings to support chemotherapy and infusion therapies, and to provide financial and travel assistance to rural cancer patients who must travel long distances for care.

Community Benefit

In return for being exempt from federal taxes, nonprofit hospitals are responsible for publicly reporting on the variety of benefits they provide, which are tailored to the needs of the communities they serve. These include financial support for those in need as well as a wide range of programs and services designed to meet the current and future health needs of those they serve. Examples include tailored programs to address identified community health needs, such as access to prescription drugs for low-income populations, free vaccinations, chronic disease management programs, transportation services for follow-up appointments and mental health services. Despite the large and pervasive payment gap between Medicaid payments and the cost of care, hospitals also routinely help to qualify or otherwise transition patients without insurance to a Medicaid plan because it is better for patients.

Programs like these and many more strengthen the bond between America’s hospitals and the communities they serve, and support hospitals’ efforts to advance health in America.

340B Hospitals: Total Benefits to the Community

How Benefits Were Calculated

The AHA contracted with RTI International to utilize the Community Benefit Insight (CBI) dataset to create a file of all electronic IRS Form 990 Schedule H data submitted for the 2022 tax year. AHA identified 1,707 tax-exempt hospitals with 340B status, of which 1,166 (68%) are individual hospital Schedule Hs and approximately 541 (32%) are part of group filings that include non-340B hospitals. Using Schedule H data from the 1,707 340B hospitals, a representative sample of all 340B non-government exempt hospitals, and AHA Annual Survey data, AHA calculated the percent of total hospital expenses and dollars spent on benefits to the community by 340B hospitals.

A more detailed technical appendix describing AHA’s methodology is available upon request. Ernst & Young (EY) confirmed that “the methodology described above is consistent with the approach used by EY in our prior analyses of the Form 990 Schedule H.”