Prepare for Shifts in Alternative Care Settings

Achieving economic stability in 2022 and beyond will be critical for hospitals and health systems as the field continues to coexist with the lingering impacts of COVID-19. As health care leaders survey the landscape ahead, developing strategies to address the expected increased use of alternative care sites will be paramount.

The AHA’s recently released 2022 Environmental Scan sponsored by B.E. Smith explores this and other key economic, innovation, health equity and delivery transformation issues. The report provides data and insights to help provider organizations reevaluate, reboot and re-imagine care delivery to create a better future.

With the effects of COVID-19 expected to continue for some time, providers can expect many of the trends that developed over the past two years to continue. Care delivered in alternative settings to hospitals, for example, is expected to increase considerably before the decade closes.

Where the Growth Will Be

Where the Growth Will Be

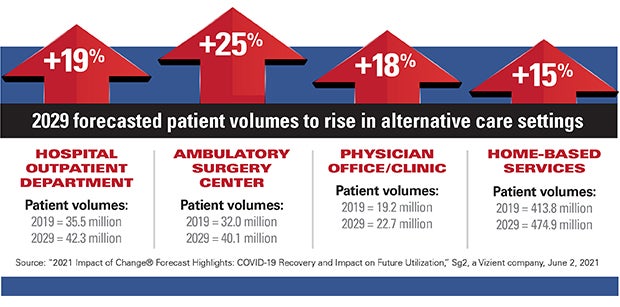

Behavioral health virtual visits will grow 50% by 2029 while hospital outpatient volumes will increase 19% and ambulatory surgery volumes will grow 25%, according to a June report from Sg2. Physician office and clinic volumes will rise 18% by 2029 while home-based services will see a 15% increase, the report notes.

The growth in hospital-at-home (HaH) volumes will help move patients out of skilled nursing facilities (SNFs) despite an aging population. More than half of health care strategists surveyed said they are very likely or likely to incorporate HaH services by 2027 for stable, chronically ill patients, according to the AHA’s Futurescan 2022-2027 report. Growth opportunities in HaH will require provider organizations to invest in chronic disease-management services, Sg2 predicts. Likewise, COVID-19 will create a lasting demand for specialist care required to support chronic COVID-impacted conditions.

Remote patient monitoring and an increased willingness of patients to use wearable tech and health devices could help support the movement toward more care being delivered at home or virtually. Remote patient-monitoring utilization is forecast to grow more than 28%, according to an Insider Intelligence report from July.

In addition, 57% of consumers who use a wearable health device or a smartphone to track wellness believe the data they capture is useful and want it collected by their doctors, according to NRC’s 2021 Healthcare Consumer Trends Report. Half of respondents who wear health tech devices also said they would allow information to be sent directly from the device to their doctor’s office.

More AHA Tools to Prepare for the Future

A companion piece to the 2022 Environmental Scan, the Leadership Discussion Guide helps hospitals and other stakeholders use the scan to strategize and think about key issues.

The AHA 2022 Health Care Talent Scan provides a road map for addressing workforce resilience, flexibility, capacity and strategy.