Should You Automate to Resolve Health Claim Denials?

Health insurance claims denied for coding issues have become a growing area of concern because of coding complexities, coding requirements and coding competency.

Absent commercial health insurance companies fulfilling a recent promise to reform their prior authorization (PA) and claims-paying behaviors, what can hospitals and health systems do to combat increasing claim denials and their growing threat to clinical and financial sustainability?

For a growing number of organizations, industry experts say the answer is automation — specifically, automation of claims management by artificial intelligence (AI)-powered technology.

A new AHA Trailblazers report, “The Case for Automating to Resolve Health Insurance Claims Denials,” explores some of the latest developments in this area.

In fact, the National Science Foundation recently awarded a $550,000 grant to researchers from St. John’s University in New York to develop an AI tool to improve medical coding and health care billing.

By replacing manual claims management tasks such as eligibility and benefit verification, PA approvals, claim submissions and appeals with smart technology that learns from its experience, hospitals and health systems are finding that they can reduce claim denials.

Hospitals and health systems that want to fix unnecessary claim denials and reclaim or recover lost revenue should consider three questions:

- Why automate revenue cycle functions and tasks?

- Why use AI-powered technology to automate those tasks?

- Why operate that technology on-site or on-premises rather than through a cloud-based solution?

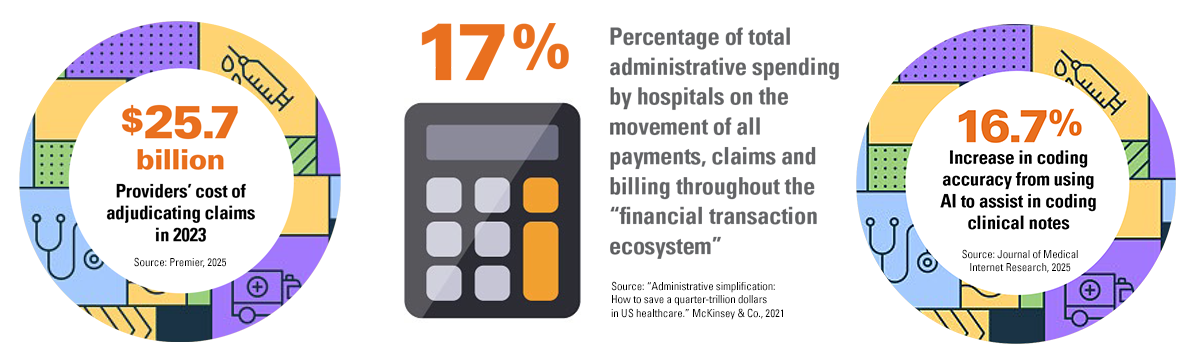

Manually performing these functions and tasks — most of which are rote and repetitive — is inefficient, time-consuming and costly. More importantly, performing these rote and repetitive functions and tasks introduces the possibility of human error along the entire revenue cycle. A misstep, no matter how small, could cause a patient’s health plan to deny or delay a claim for a patient’s medically needed services.

Automating them with smart technology improves efficiency, consumes less time, reduces costs and eliminates human errors that can lead to claim denials or delays. Download the full report.

SPONSORED BY Ailevate